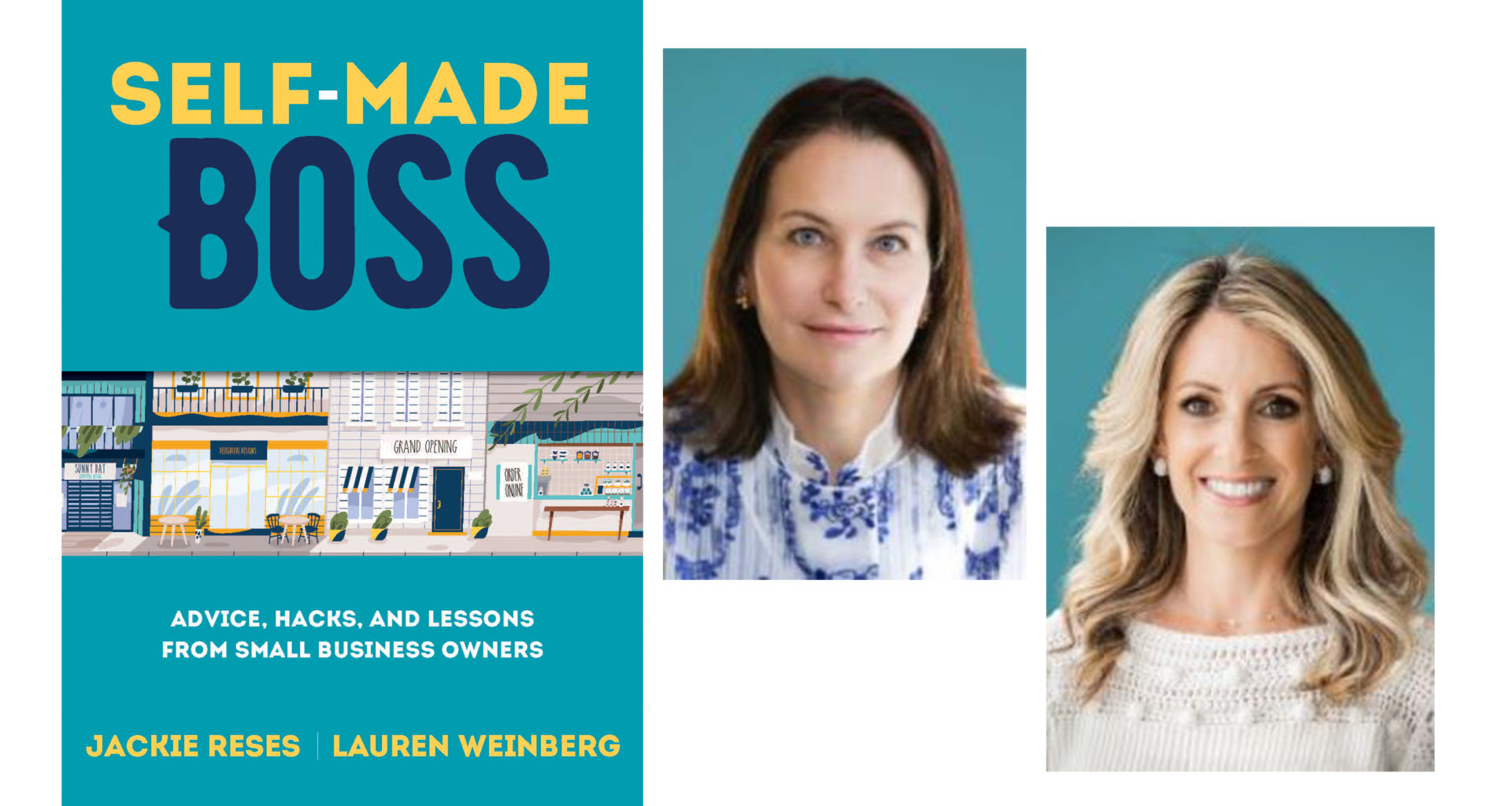

Adapted excerpt from “Self-Made Boss: Advice, Hacks, and Lessons From Small Business Owners” by Jackie Reses and Lauren Weinberg (McGraw Hill/2022) ©2022 by Jackie Reses and Lauren Weinberg. All rights reserved.

Small businesses have about a 50-50 chance of surviving the first five years – and one in five don’t even make it a full 12 months, according to the U.S. Bureau of Labor Statistics.

Businesses have a much better shot at long-term survival and success if they lay out their vision for the future before, not after, they start running it.

This means writing a business plan, and it’s one of the most important steps in building a successful company. Sometimes this business plan is written for public consumption. For instance, if you would like anyone else to put money into your company – which could be in the form of a grant, stock shares, or a loan – you will need a polished business plan. A bank will certainly want to see one before approving a loan. Your family and friends might have fewer requirements before sending you a check, but a written plan will still help set their minds at ease by demonstrating that you’re taking your venture seriously.

Even if you don’t intend to take loans or outside investors, and even if you don’t have anyone to read your business plan, systematically thinking through a blueprint is still critical. Yvonne Cariveau, director of the Center for Innovation & Entrepreneurship at Minnesota State University’s College of Business, is an expert on business plans. She says that you don’t necessarily need to write out a buttoned-up essay, but you do need to do the thinking and research that a business plan forces you to perform.

A business plan has multiple sections:

An Executive Summary

The Management Team

Problem, Solution, and Audience

Operations

Finances

Marketing

As you write your business plan:

Have a vision. Present your vision for what you believe you are building. A vision can be more future looking and optimistic about your goals. Be as clear-eyed as you can be in stating what you want to be.

Be logical. Think like a banker or an investor for the concrete details, not a dreamer.

Support your claims with statistics, facts, and quotes from knowledgeable sources.

Don’t discuss rumors. Hearsay about your competitors doesn’t belong in a business plan.

Avoid superlatives. Major, unique, the first, the only, the best, the most, unbelievable, amazing, terrific – none of these words should have a place in your plan. In most instances, you can’t back up these claims with data, because they are, at their core, opinions. There’s no way, for instance, to prove that you have the best Mexican food in town. (You can however, quote someone else saying that – a food reviewer, for instance – if it will add credibility.) There’s also a very good chance that your product or service is not truly the first or unique. That’s fine. The world has room for more than one vintner. Just be truthful in what you claim.

Be realistic. Don’t overestimate your financial projections or underestimate your time frames. Assume that your business will bring in half the revenue that seems reasonable and take twice the time you initially estimate to get up and running. If you’re able to bring in more money in less time, that’s great. Make the surprises good ones.

Hire or contract with an accountant or a financial expert to help you think through the financial side of your business. If you’re writing a business plan for investors or lenders, ask the accountant to put your financial projections in the standard business format that your audience expects.

Don’t send investors a gimmick. They’ll eat the cookies that you send, but the baked goods won’t make them more likely to invest in your business. Investors want facts, not snacks.

Ask for help

Whether you create a formal business plan or not, thinking through a proposed business is a lot of work. You don’t have to hire someone with an MBA or pay consultants — not at first, anyway. You can get help, usually for free, from a wide variety of sources:

- The Small Business Administration (SBA) is often the quickest way to find free help. It funds small business development centers (SBDC), often hosted by large universities, which can help you one-on-one for as long as you need.

- Your local chamber of commerce likely has resources and relationships with advisors and business content.

- County and city governments, as well as local, state, and federal lawmakers, often offer grants to help small businesses.

- Retired people from your industry might be happy to coach you, or you could join a group of current entrepreneurs who meet regularly for advice and support. Chambers of commerce and SBDs can help you find both.

- Workforce Investment Boards exist in every state. They help unemployed people find jobs and offer subsidies to business owners to hire an employee for three to six months. They may also offer subsidized employee training.

“Self-Made Boss: Advice, Hacks, and Lessons From Small Business Owners” can be purchased via StartupNation.com below.