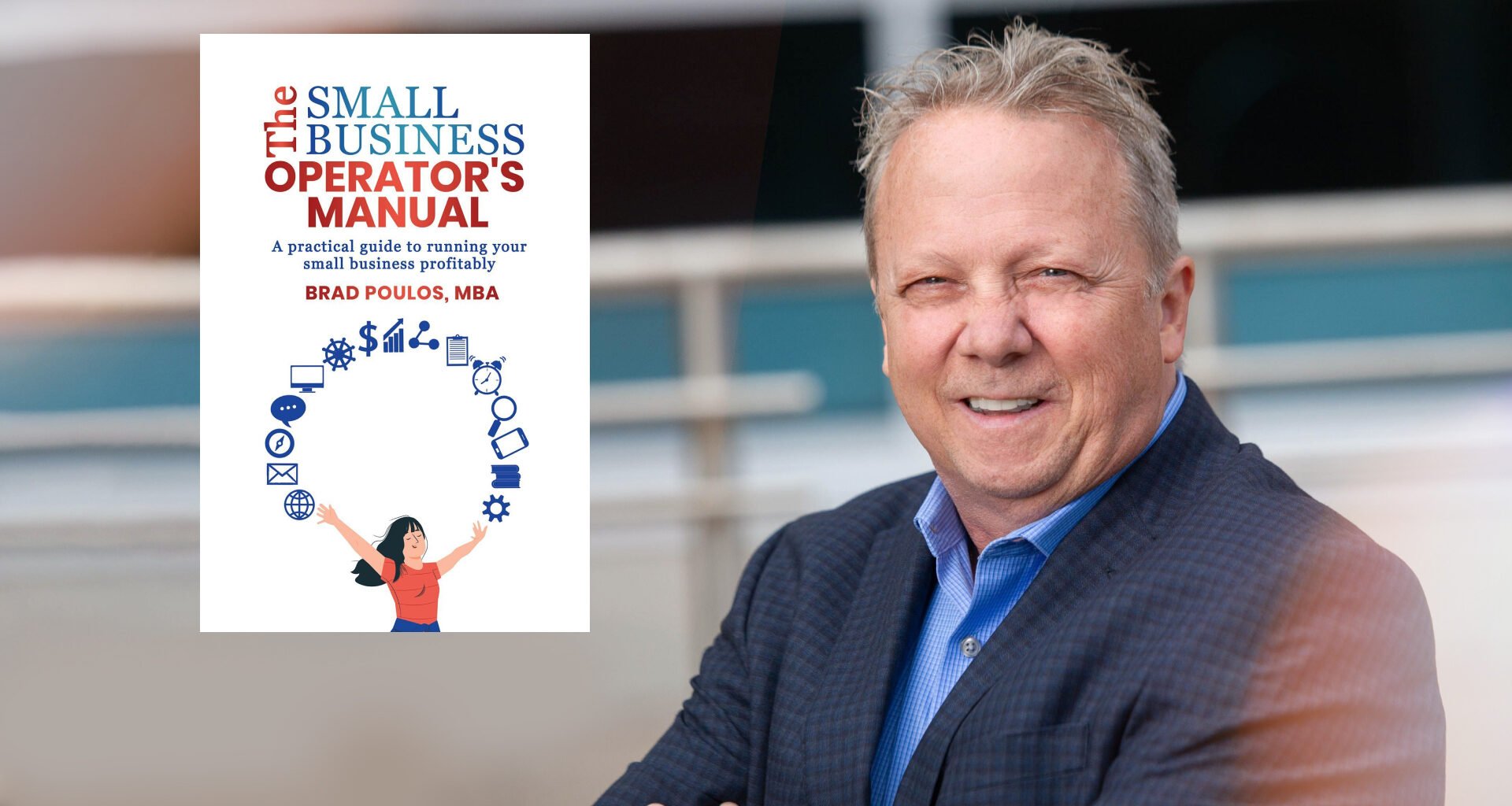

The following is an excerpt from “The Small Business Operator’s Manual: A practical guide to running your small business profitably” by Brad Poulos. Owner Mentors Press, a div. of Brad Poulos Holdings Inc.

One of the most ill-advised moves that many business owners make is the addition of minority shareholders. There are two common motivators:

- attract or retain key individuals, and incent them to give even more; or

- bring in external equity financing.

I will debunk both of those.

Minority Share Sale to Key Employee

The first example requires one to understand what rights one gains as a minority shareholder. There are three things to which any shareholder is entitled, and they’re not very exciting.

1. Information – but not any or all information. Just basic financial information (not audited, by the way) and only once a year, plus a right to be informed about really big events (like, company changing big!). As a practical matter, wouldn’t these key individuals already be getting this information? There’s not much of a gain here.

2. Influence (by way of a vote) – maybe, and only on certain things! Voting rights on shares is a complicated issue but suffice it to say that this is not worth a lot to the minority shareholder for several reasons. First, your shares might not even get a vote (many shares are non-voting). Second, you would only vote on really big things (like, company changing big!). Third, your vote won’t ever amount to anything meaningful because the majority owner will just outvote you every time. So again, not much of a gain to the employee here.

3. Share of Profits (by way of dividends) – which most small businesses don’t pay! In most cases, small business owners will prefer salary and year-end bonuses as opposed to dividends as a means of reducing overall taxes paid. One presumes that the key person status that this employee holds would put them in a position to negotiate a better bonus for themselves, giving them more of the profits without having to buy any shares at all.

The only potential – and one must stress potential – reason left for buying shares in a small private company is the payday the owners could receive in a liquidity event (essentially a sale of the company). But the Performing Small Business is not a company being built to be sold, so this should be a remote possibility and not a motivating factor in buying shares.

The use of minority partners to raise equity is also often very ill-advised for mostly the same reasons that you should avoid creating them as a key employee retention strategy.