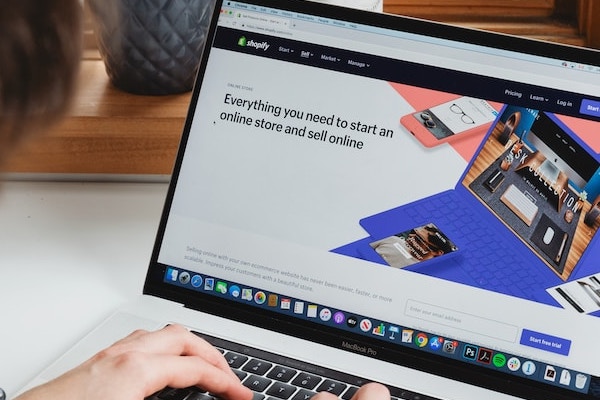

The bustling world of e-commerce can be as thrilling as it is challenging, especially when it comes to the nitty-gritty of financial management. Have you ever felt overwhelmed trying to balance the books or decipher financial data for your Shopify store? You’re not alone!

As the e-commerce landscape expands, so does the need for robust and user-friendly bookkeeping solutions. Dive in as we explore the best Shopify bookkeeping software to simplify this crucial aspect of your business.

QuickLook: Best Shopify Bookkeeping Software

Do You Need Bookkeeping for Your Shopify Store?

Bookkeeping is the backbone of any successful e-commerce business, including your Shopify store. And beyond merely cataloging transactions, it offers a deep dive into your store’s financial wellness — empowering you with data-driven decisions and keeping you in line with tax obligations.

Here are some key benefits of bookkeeping for your Shopify store:

- Financial Clarity: Accurate bookkeeping provides a clear snapshot of where your money is coming from and where it’s going, allowing for better budgeting and forecasting.

- Tax Compliance: Proper financial records ensure that you report and pay the right amount of taxes, avoiding potential penalties.

- Informed Decision Making: With detailed insights into your financial data, you can make strategic decisions to drive growth and profitability.

- Investor and Lender Readiness: If you’re looking to attract investors or secure loans, up-to-date books can showcase your business’s viability.

- Error Detection: Regular bookkeeping can help identify discrepancies or fraudulent activities early on, safeguarding your business assets.

How Does Shopify Bookkeeping Work?

Shopify bookkeeping involves tracking and recording all financial transactions related to your online store. While Shopify offers basic financial reporting, it doesn’t provide comprehensive bookkeeping features. You can track sales, returns, expenses, and other financial data.

But as your store grows, manually managing these records becomes tedious. This is where external bookkeeping software comes in. Integrating such tools with Shopify ensures automated, accurate, and detailed financial reporting.

Best Shopify Bookkeeping Software and Tools

While Shopify offers an array of tools, it’s often the integration with specialized bookkeeping software that truly elevates a store’s financial management. Let’s delve into some of the best software and tools tailor-made for Shopify bookkeeping, ensuring you have the optimal setup for your business.

1. A2X

Accurate ecommerce accounting

- Connect your channels with QuickBooks or Xero

- Save hours on your monthly bookkeeping

- Grow profitably with financial visibility

A2X stands out for its ability to handle multi-channel e-commerce sellers, making it an invaluable tool for Shopify entrepreneurs expanding their reach. It offers automated accounting, capturing every transaction detail, ensuring precision in financial reports and tax compliance.

Key features of A2X include:

- Automated Financial Reporting: Generates detailed financial reports, giving insights into sales, fees, costs, and more.

- Multi-Channel Accounting: Supports accounting for various e-commerce platforms, ensuring consistency across all sales channels.

- Tax Compliance: Automates the calculations for various tax obligations, simplifying tax reporting and submissions.

- Currency Conversion: Automatically converts foreign currency sales into your home currency, ensuring accurate financial records.

Pricing:

- Mini: $19/month

- Basic: $39/month

- Professional: $69/month

Pros:

- High Precision: Accurately captures and categorizes every transaction detail.

- Time-saving: Automates many of the tedious aspects of e-commerce accounting.

- Integration: Seamless integration with both accounting software and e-commerce platforms.

- Support: Offers robust customer support, assisting users in setting up and troubleshooting.

Cons:

- Learning Curve: May require some time for users unfamiliar with accounting concepts.

- Pricing: While comprehensive, some users may find the advanced plans pricey.

- Overwhelming Detail: Some users may find the level of detail in reports overwhelming.

- Integration Limits: While it covers many platforms, not all e-commerce channels might be supported.

2. FreshBooks

With a focus on usability, FreshBooks caters to small businesses and freelancers, making bookkeeping tasks straightforward for the modern entrepreneur. Aside from its core accounting features, it offers tools for invoicing, time-tracking, and expense management, positioning itself as an all-encompassing financial hub for Shopify store owners.

Key features of FreshBooks include:

- Easy Invoicing: Customize and send professional invoices in a matter of minutes.

- Expense Tracking: Snap photos of receipts or link your bank account to automatically track expenses.

- Time Tracking: Monitor the time spent on various tasks and bill clients accordingly.

- Reports & Analytics: Generate insightful financial reports that aid in decision-making.

Pricing:

- Lite: $17/month

- Plus: $30/month

- Premium: $55/month

Pros:

- Intuitive User Interface: Easily navigable, even for those new to accounting.

- Robust Integrations: Syncs with numerous apps and platforms, including Shopify.

- Automated Features: Reduces manual work with automated invoicing and follow-ups.

- Excellent Support: Offers top-notch customer service, assisting in setup and queries.

Cons:

- Limited Customization: Some users might find the customization options limited.

- Pricing Tiers: While the Lite version is affordable, the cost can increase with added features.

- Foreign Currency Fees: Conversion rates can add extra costs for international transactions.

- Storage Limitations: Depending on the plan, storage can be limited, especially for the lower-tiered plans.

3. Bench

Accurate financials.

Total peace of mind.

Bench helps small business owners like you save time and money doing your bookkeeping and income taxes by providing dedicated experts and easy-to-use financial software—so you can focus on growing your business.

Taking a novel approach to bookkeeping, Bench melds cutting-edge software with the human touch of professional bookkeeping services. Aimed at Shopify store owners, Bench promises the reliability of automation alongside the personalized attention of financial experts. This ensures that each month’s financial data is not just collected but meticulously reviewed, with added support come tax season.

Key features of Bench include:

- Dedicated Bookkeepers: Each user gets a personal bookkeeper to ensure accurate and timely reports.

- Financial Visuals: Interactive financial statements that allow users to visualize their financial standing.

- Tax-ready Financials: Year-end financial packages that are ready for tax filing.

- Cash Flow Insights: Understand the ins and outs of your business’s money movement.

Pricing:

- Essential: $249/month

- Premium: $399/month

Pros:

- Personal Touch: Combines software automation with real-life bookkeeping professionals.

- Tax Support: Provides valuable assistance for year-end tax preparations.

- Transparent Reporting: Offers clear, easy-to-understand monthly financial reports.

- Time-saving: Automated processes, coupled with expert oversight, save significant time.

Cons:

- Pricing: Some small businesses may find the service costly, especially at the beginning.

- Limited Integrations: May not seamlessly sync with all third-party applications.

- Service Scope: Not a full-fledged accounting tool, primarily focused on bookkeeping.

- Onboarding Time: Initial setup and integration can be time-consuming.

4. QuickBooks

QuickBooks, a behemoth in the world of accounting software, extends its expertise to cater specifically to e-commerce businesses like Shopify stores. Its versatility is evident in its expansive range of features, with tools that stretch beyond mere bookkeeping, encompassing areas like inventory tracking and payroll, making it an indispensable asset for merchants yearning for an all-in-one financial solution.

Key features of QuickBooks include:

- E-commerce Integration: Directly syncs with Shopify, simplifying sales tracking and revenue management.

- Inventory Management: Keeps tabs on stock levels and helps manage orders, avoiding overstocking or stockouts.

- Payroll Management: Streamlines the payroll process, ensuring your team gets paid on time with the right deductions.

- Tax Tools: Calculates sales tax and prepares tax forms, facilitating smoother tax filing.

Pricing:

- Simple Start: $18/month

- Essentials: $27/month

- Plus: $38/month

Pros:

- Comprehensive: Offers a wide range of accounting and bookkeeping tools in one platform.

- Reliability: Backed by years of industry reputation and trust.

- Scalable: Suitable for businesses of all sizes, from startups to established enterprises.

- Extensive Support: Offers a vast library of tutorials, webinars, and 24/7 customer support.

Cons:

- Learning Curve: Given its broad feature set, it might be overwhelming for beginners.

- Pricing: Advanced features come at a higher price, making it a significant investment.

- Interface: Some users find its interface less intuitive compared to newer platforms.

- Integration Issues: Occasionally, syncing issues with Shopify might arise, requiring manual adjustments.

5. Xero

Get back to what you love with Xero accounting software

Spend less time in the books

Try accounting software for everyday businesses. With features and tools to save you time.

Xero has established itself as a popular alternative in the cloud accounting arena, with a focus on user-friendliness and robust automation. Tailored to serve a variety of businesses, including e-commerce platforms like Shopify, Xero streamlines the accounting process, making financial management seamless and efficient.

Key features of Xero include:

- Direct Bank Feeds: Automatically imports transactions, minimizing manual data entry.

- E-commerce Integration: Simplifies reconciliation by syncing with Shopify and other e-commerce platforms.

- Inventory Tracking: Manages products, stock levels, and supplies, enhancing order fulfillment.

- Collaboration Tools: Allows for multi-user access and real-time collaboration with accountants or team members.

Pricing:

- Early: $15/month

- Growing: $42/month

- Established: $78/month

Pros:

- Intuitive User Interface: Simple and straightforward, suitable even for those new to accounting.

- Efficient Automation: Reduces manual tasks through automated bank feeds and invoicing.

- Scalability: Plans available to cater to both small businesses and growing enterprises.

- Extensive App Marketplace: Offers a variety of third-party integrations to enhance functionality.

Cons:

- Limited Features in Starter Plan: The basic plan may be too restrictive for some businesses.

- Payroll Limitations: Enhanced payroll features require higher-tier plans.

- Learning Curve: While user-friendly, some features might take time to master.

- Additional Costs: Some third-party integrations come with added fees.

6. Wave

Payroll software that pays off

Small business payroll that makes paying employees, contractors, and yourself, easy!

Wave offers a free yet powerful bookkeeping solution, making it a go-to for budding Shopify entrepreneurs. It boasts an array of features like invoicing, payments, and payroll, all while maintaining a simple and easy-to-navigate interface.

Key features of Wave include:

- Free Invoicing and Accounting: Allows businesses to create and send professional invoices without any cost.

- Integrated Payments: Accepts credit card payments and bank transfers directly from invoices.

- Automatic Expense Tracking: Connects to bank accounts to track income and expenditures seamlessly.

- Payroll Management: Handles tax calculations and direct deposits, streamlining employee payments.

Pricing:

- Accounting & Invoicing: $0 – Completely free access to core accounting and invoicing features.

- Payments: Pay-per-use rates for credit card processing and bank payments.

Pros:

- No Monthly Costs: Most essential features are available without a monthly subscription fee.

- User-Friendly Interface: Simplified dashboard and tools cater to both novices and seasoned business owners.

- Versatile Invoicing Options: Customizable invoice templates and automated recurring billing.

- Transparent Pricing: No hidden fees for payment processing; rates are clearly outlined.

Cons:

- Limited Advanced Features: While great for basic bookkeeping, might lack some advanced functionalities.

- Payroll Costs: Full payroll features come with added costs.

- No Inventory Tracking: Not ideal for businesses with complex inventory needs.

- Limited Third-Party Integrations: Might not offer as extensive an app ecosystem as some competitors.

7. Zoho Books

Online accounting software, built for your business.

Zoho Books is online accounting software that manages your finances, automates business workflows, and helps you work collectively across departments.

Zoho Books forms a key part of the Zoho ecosystem, geared primarily towards small and medium enterprises. Its integration capabilities make it a standout choice for those using other Zoho products. Notably, its automation prowess aids in reducing manual data entries and errors, allowing Shopify sellers to focus more on sales than on back-end operations.

Key features of Zoho Books include:

- Automated Bank Feeds: Connects to bank accounts to automatically categorize transactions and reconcile accounts.

- Inventory Management: Offers real-time tracking of inventory quantities and values.

- GST Compliant: Especially helpful for businesses in regions requiring GST, as it automates many tax tasks.

- Time Tracking & Projects: Lets businesses track billable hours and project profitability.

Pricing:

- Standard: $15/month

- Professional: $40/month

- Premium: $60/month

Pros:

- Extensive Integrations: Integrates well with other Zoho products and many third-party apps.

- Robust Automation: Reduces manual work with features like recurring billing and auto charge.

- User-Friendly Interface: Offers an intuitive experience even for non-accountants.

- Client Portal: Clients can log in to view statements, make payments, and collaborate.

Cons:

- Limited Customization: While it’s feature-rich, some users might find customization options restricted.

- Learning Curve: Given its many features, new users might need time to familiarize themselves.

- Pricing Tiers: Some essential features are locked behind higher pricing tiers.

- Limited Multi-Currency Options: Not as versatile for businesses operating in multiple currency zones.

8. Sage Intacct

The leader in cloud financial management software

Whether you’re a growing startup or an established public company, we’re the right partner for your long-term success.

Sage Intacct caters to larger businesses and enterprises, offering a more robust financial management platform. With its multi-dimensional data model, it allows Shopify merchants to extract insights, forecast trends, and navigate complex financial terrains with ease.

Key features of Sage Intacct include:

- Multi-Dimensional General Ledger: Allows businesses to capture and analyze data at a granular level for strategic decision-making.

- Automated Workflows: Enhances efficiency by reducing manual processes, ensuring smooth financial operations.

- Advanced Revenue Management: Facilitates compliance with revenue recognition rules and automates complex transactions.

- Customizable Dashboards: Offers real-time financial insights with a user-friendly interface tailored to business needs.

Pricing:

- Custom Quote: Required to speak with a representative to get an estimate for custom needs.

Pros:

- Scalability: Designed to grow with businesses, making it suitable for long-term planning.

- Integration Capabilities: Can seamlessly integrate with other enterprise-level software and tools.

- Compliance and Security: Offers top-notch security and ensures businesses remain compliant with financial regulations.

- Customer Support: Known for its responsive and knowledgeable customer support team.

Cons:

- Pricing: Might be on the higher side for small businesses or startups.

- Complexity: Given its robust features, there’s a learning curve involved for new users.

- Customization Limitations: While feature-rich, some might find specific customization options lacking.

- Setup Time: Implementing and setting up the software might take longer compared to simpler solutions.

9. Plooto

Your Business Payments, Streamlined, Simplified, and Automated

With Plooto's accounts payable and receivable software, spend more time on growing your business, and less on managing your payments.

Plooto shines in automating accounts payable and receivable for Shopify businesses. With its focus on streamlining payments and reducing transaction times, it’s a boon for merchants aiming to simplify their financial operations.

Key features of Plooto include:

- Automated Accounts Payable: Schedule, approve, and send payments with a few clicks, reducing manual checks and wire transfers.

- Automated Accounts Receivable: Send invoices and receive payments directly into your bank account, all within the platform.

- International Payments: Seamlessly send and receive payments across different countries and currencies.

- Integrated Financial Reports: Get real-time insights on your financial status, making reconciliations and reporting easier.

Pricing:

- Go: $9/month

- Grow: $32/month

- Grow Unlimited: $59/month

Pros:

- Seamless Integrations: Easily integrates with major accounting software like QuickBooks and Xero.

- Enhanced Security: Uses bank-grade encryption to ensure the safety of all transactions.

- User-Friendly Interface: Simplifies complex financial processes with an intuitive design.

- Custom Approval Workflows: Allows businesses to set custom approval processes ensuring oversight and control.

Cons:

- Limited Advanced Features: While great for payments, it may lack certain advanced financial management features.

- Transaction Fees: For businesses with high transaction volumes, costs can add up.

- Learning Curve: While user-friendly, new users might require some time to familiarize themselves with all the features.

- Limited Customization: Some businesses might find customization options to be limited.

10. Kashoo

The World’s Simplest Accounting Software

We build accounting and finance tools for small business owners. Whether you need to send your first invoice, file your first tax return, or if you’re ready for traditional accounting software with customizable chart of accounts—we’ve got the tool for you!

Kashoo, with its cloud-based interface, promises simplicity without compromising on features. Ideal for small businesses, it integrates smoothly with Shopify, providing straightforward bookkeeping, expense tracking, and insightful reporting.

Key features of Kashoo include:

- Intuitive Dashboard: An organized hub to view income, expenses, outstanding invoices, and other key metrics.

- Multi-Currency Support: Easily handle transactions in various currencies, making it suitable for businesses with an international clientele.

- Recurring Invoicing: Automate the invoicing process for regular clients, ensuring timely and consistent billing.

- Bank Reconciliation: Synchronize your bank account details with Kashoo, making it easier to match and categorize transactions.

Pricing:

- Truly Small Accounting: $216/year

- Kashoo Advanced: $324/year

Pros:

- User-Centric Design: Simplified workflows and interfaces tailored for non-accountants.

- Responsive Customer Support: Accessible support team ready to assist with queries or technical hitches.

- Regular Updates: The platform is consistently updated to keep up with accounting standards and user needs.

- Secure Data Encryption: Ensures all financial data remains confidential and protected against breaches.

Cons:

- Limited Advanced Features: Might not cater to businesses looking for in-depth financial analysis tools.

- No Dedicated Mobile App: While the platform is mobile-responsive, there’s no standalone app for on-the-go access.

- Integration Limitations: While it integrates with Shopify, it might have limited integrations with other third-party platforms.

- Fixed Pricing Model: Some businesses might prefer a more flexible, pay-as-you-go pricing structure.

What to Look for in Shopify Bookkeeping Software

As you dive into the plethora of options available, there are critical features and considerations to prioritize to ensure your choice truly aligns with your business needs. Let’s go over these below:

Integration with Shopify

It’s important that the accounting software you choose works seamlessly with Shopify. Such integration means that sales and financial data are automatically synced, eliminating manual data entry or the hassle of exporting and importing files. This not only saves time but also reduces the risk of errors that can arise from manual intervention.

Accurate and Automated Tracking

Accuracy is at the heart of bookkeeping. Choose software that lets you track sales, expenses, inventory, and other relevant financial transactions in real time. Beyond just tracking, the best programs offer automation features such as automatic categorization of transactions and reconciliation of bank statements.

Robust Reporting and Analytics

Your chosen software should come equipped with in-depth, customizable reports, granting you insights into the financial health of your venture. Essential features include profit and loss statements, comprehensive sales reports, tax summaries, and insights into inventory valuation.

Tax Compliance

Prioritize software that aids in maintaining tax compliance, providing features like automated sales tax calculations, assistance with tax filings, and generating detailed tax reports. This ensures you’re always in line with the regulations, avoiding potential legal pitfalls.

Balancing the Books and Looking Ahead

In the vibrant world of e-commerce, where countless stores compete for attention, careful accounting can help you stand out from the crowd. This article has shown how important organized bookkeeping is for your Shopify store.

In a market as competitive as e-commerce, it’s the attention to detail that can make the difference between success and mediocrity. So as we step forward, let’s prioritize precision in our books and consistency in our efforts — because in this race, every detail counts.

FAQs

What are the key financial statements I need to track for my Shopify store?

The essential financial statements for your Shopify store include the Income Statement (or Profit and Loss), Balance Sheet, and Cash Flow Statement. Together, these provide a comprehensive overview of your store’s profitability, financial position, and cash movements.

How can I ensure accurate bookkeeping for my Shopify store?

Ensuring accurate bookkeeping starts with regular record-keeping, timely data entry, and frequent reconciliations. It’s also beneficial to invest in reliable bookkeeping software that integrates seamlessly with Shopify.

Can I integrate my Shopify store with bookkeeping software?

Yes! Most modern bookkeeping software solutions offer integration capabilities with Shopify. This integration allows for automatic syncing of sales and financial data.

How can bookkeeping help me improve my Shopify store’s financial performance?

By analyzing these financial insights, you can identify areas of improvement, optimize operations, and make informed decisions to enhance profitability and cash flow.

What happens if I neglect or delay my Shopify bookkeeping?

Neglecting or delaying bookkeeping can lead to inaccurate financial records, making it challenging to gauge your store’s true financial health. This oversight can also lead to non-compliance with tax regulations, resulting in potential penalties.