While 48% of new freelancers view freelancing as a long-term career choice, this is only realistic if you have a long-term financial plan.

While freelancing comes with advantages, such as flexibility and independence, there are also plenty of drawbacks. You’ll need to cover your own benefits, build an emergency fund and plan around inconsistent income. But if you have a good financial planning in place, you can thrive as a freelancer and enjoy stable finances at the same time.

In this article, I will share the top financial habits that will help you achieve this balance.

Win a $1,000 Black Friday Shopping Spree from Dell and StartupNation

What is financial planning and why is it important? Simply put, financial planning is a long-term strategy that helps you cover your current and future costs and mitigate the impacts of unforeseen changes.

Financial planning not only helps you to cover the expenses of fixed costs (like your rent or utility bills), but it also helps you to manage the less attractive elements of freelancing.

Domains, Websites, Email, Hosting, Security & More. Everything You Need To Succeed Online. Your Website Starts With The Perfect Domain. Getting Online is Easy with GoDaddy. World's Biggest Registrar.

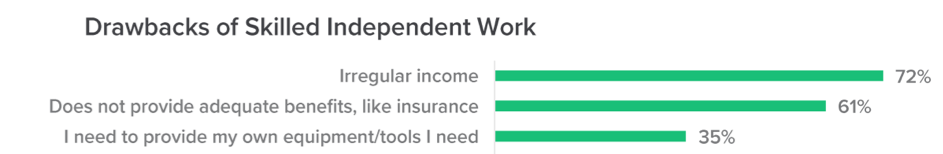

According to freelancers who participated in Fiverr’s 2020 Annual Freelance Economic Impact Report, the top three drawbacks of being an independent worker are irregular income, a lack of benefits and having to provide their own tools and equipment.

While workers who are full-time employees of a company often receive benefits and resources to work with, freelancers need to rely on their own financial planning to cover these costs. This is especially poignant considering the irregularity of paychecks when fulfilling contract work.

Beyond your monthly expenses, financial planning helps you to build a stable future. Imagine you plan to buy a house or have children. Financial planning helps you spread the income you earn now to cover some of those future expenses.

Financial planning also helps you to prepare for growth in your career and helps you keep afloat if circumstances change. With a robust financial plan in place, you’re less susceptible to the impacts of negative changes, such as the loss of a client or a downturn in the market.

For example, over the last year, 63% of freelancers had one or more contracts postponed while 53% had at least one contract canceled.

Financial planning helps you to prepare for these kinds of unforeseen changes that may impact your income.

$10K Verizon Grants And Other Free Benefits For Entrepreneurs

Creating short-term and long-term financial goals

A reported 30% of freelancers say they’re worried about not having enough money to put into savings.

By creating short-term and long-term savings goals, you can work your savings scheme into your monthly expenses:

- Short-term goals are likely to take a month to a year to reach and include expenses for home improvements, furniture, vacations, etc.

- Long-term goals include any targets that take five or more years to reach. These include your retirement fund, mortgage, child’s college tuition, significant debts, etc.

As Anya Campbell Smith, founder of Millennial Money Guide, advises, “If I’ve learned anything from my own personal finance journey, it’s this: specific money goals get accomplished!”

Campbell Smith suggests you:

- Articulate your goal clearly

- Figure out the exact amount you need to reach it

- Break it down into manageable, realistic steps

- Itemize your goals to hold yourself accountable

Sign Up: Receive the StartupNation newsletter!

10 financial planning habits for freelancers and entrepreneurs

If you want stable finances, you need healthy financial planning habits. Here are the top 10 habits of financially sound entrepreneurs and freelancers.

Create a website without limits. Build and scale with confidence. From a powerful website builder to advanced business solutions—we’ve got you covered.

Try Wix. No credit card required.

1. Understand profit versus revenue

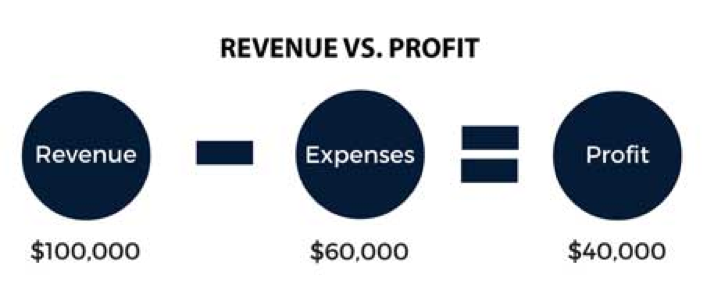

Many freelancers and entrepreneurs get confused between revenue and profit.

Your revenue is the total amount that is generated by the sales of goods or services before expenses are taken out.

Profit is the total amount remaining after expenses, company debts, operating costs and taxes are taken out.

All budgets, savings schemes and personal debt repayments should be made based on your profit, not your revenue.

2. Maintain your budget

Approximately 72% of freelancers say that having an irregular income is the biggest downfall of freelancing. That’s because an inconsistent income makes it tricky to budget. However, it’s important to create a plan that spreads your income so that you cover your expenses now while also saving for the future.

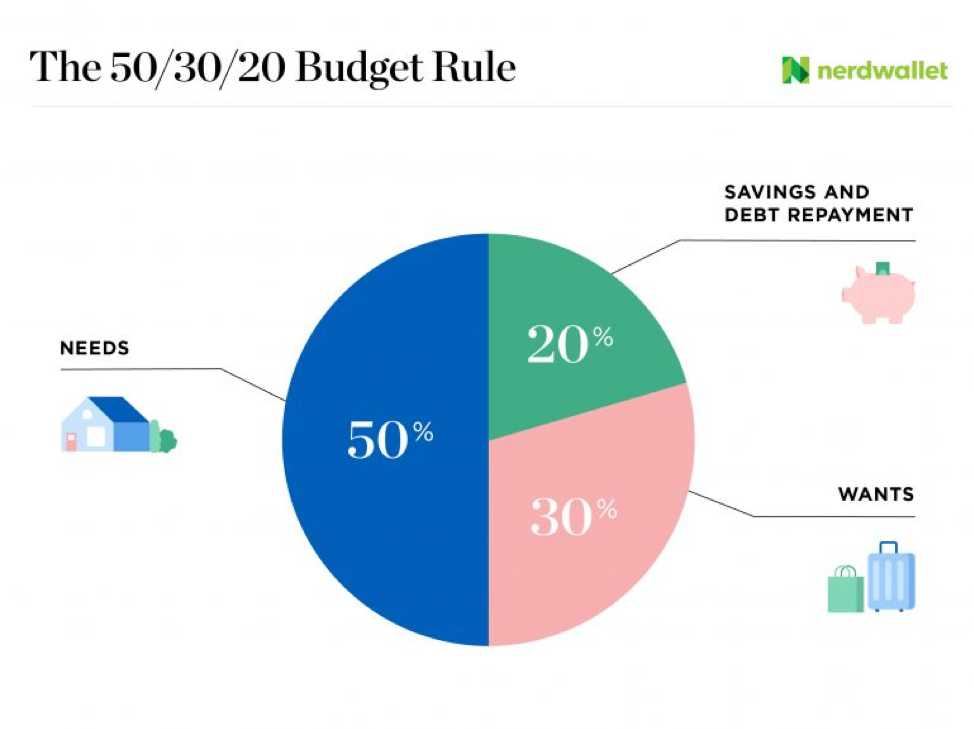

One of the best budgeting techniques to use is the 50/30/20 rule.

First, work out your necessary fixed costs. This includes your food, basic utilities, housing, transportation, insurance, child care, minimum loan repayments and so on. This should account for 50% of your income.

Create a customizable website or online store with an all-in-one solution from Squarespace. Choose a website template and start your free trial today.

Next, calculate your savings goals, retirement fund and debt repayments; 20% of your income should go toward these expenses.

This leaves 30% for guilt-free spending on things you want, such as entertainment, meals out and vacations.

3. Keep track of everything in a dedicated business account

Don’t mix your business expenses with your personal expenses. Get a dedicated business bank account, so you can monitor all income and expenses without confusion. This stops you from accidentally spending revenue that isn’t profit before you’ve covered expenses.

Not only will this help you to track everything more easily, but it also builds business credibility when you’re charging clients. Plus, it may be helpful in the future if you need to ask banks for credit. You won’t be able to access these financial products without a separate business account.

4. Pay your debts

While paying off your debts might be a long-term savings goal, they should be a top priority. All the while you’re in debt, you’re paying extra money out to cover the interest on that debt. This takes profits out of your pocket.

Not only does debt affect your present income, but it also impacts your ability to use other financial services in the future. If you have debt or a poor credit score, you’ll have a harder time accessing business loans or extra lines of credit to expand your company in the future.

5. Allocate money for taxes

You must account for your taxes when considering the profits you make. The amount of tax you pay will depend on where you’re based, but if you fail to pay your taxes, you may face extreme consequences such as fines and criminal charges.

Don’t leave your taxes until the end of the tax year. Work out how much annual tax you’ll pay using a tax calculator. Divide this by 12 months, and set this amount aside as soon as you get paid.

6. Give yourself a paycheck

As business guru Tony Robbins explains, “Although contracting can be a rollercoaster ride of peaks and valleys in your income, give yourself the gift of a consistent paycheck. This will reduce your stress and make monthly budgeting much easier.”

If you know how much is coming into your personal bank account each month, it’s much easier to stick to a personal budget and cover all expenses. And when your business is doing well, the extra revenue earned over your designated salary amount remains in your business account to cover your salary during months when you see lower revenue coming in.

7. Build an emergency fund

According to Brian Decker, CEO of Modern Lending, the top habit of self-made millionaires is that they have a $10,000 emergency fund.

While you may not need or have $10,000, it’s a good idea to work toward having a few months of emergency money in the bank just in case your circumstances change.

Not only does this mean you’ll have a safety net, but it also gives you the freedom to be picky with contracts so you’re not stuck doing work you don’t enjoy simply because you need the cash.

8. Consider getting insured

According to the aforementioned Fiverr survey, 61% of freelancers admit that a lack of benefits, such as no health insurance, is another real drawback of freelancing. If you don’t have health insurance, you’ll find yourself dishing out wads of cash when you’re unwell. This is an unexpected expense that can hit freelancers and entrepreneurs hard.

As True Blue Life Insurance explains, “Self-employed people and freelancers are not eligible to deduct their life insurance premiums as a business expense, either. They fall under the same considerations as individual policies.”

Consider investing in public liability insurance and health insurance to cover these unexpected expenses.

9. Save for retirement

An Upwork study shows that 68% of freelancers say they’re concerned about saving for retirement.

When you’re self-employed, the responsibility for your future rests on your shoulders. This is why you need to factor in retirement savings into your monthly savings plan.

Consider a Traditional IRA or Roth IRA. You can contribute up to $6,000 a year (or $7,000 if you’re 50 or older), and future withdrawals are tax free.

Alternatively, set up a SEP IRA or a Solo 401(k). You can add anywhere from 25% of your net income to $58,000 per year (whichever is less).

10. Diversify your income streams

If all of your income comes from just one client, you’ll be in real trouble if that client chooses to terminate your contract. Try to build multiple income streams from different clients to create resilience in your portfolio. That way, if you lose one client, you have others to fall back on.

You could always try diversifying your skills: In the last six months, 59% of freelancers have participated in skills training versus 36% of non-freelancers. If you’re worried about relying on one form of income, try doing the same to broaden your skill set.

Key takeaways on financial planning

Financial planning is vital to your stability as a freelancer. If you’re not planning out your short- and long-term finances, you’ll find yourself floundering if unexpected changes occur.

Remember, it’s your responsibility to cover your bases. You need to make sure you first understand the differences between revenue and profit, and you must provide yourself with a paycheck and retirement fund as well as covering all your taxes.