If your business received an Economic Injury Disaster Loan (EIDL) or Paycheck Protection Program (PPP) loan, you may have determined it isn’t a good fit for your small business for any number of reasons:

- You just wanted the EIDL grant and not an EIDL loan,

- You didn’t understand the loan terms when you applied,

- You can’t use the EIDL funds or PPP funds the way you hoped

- You don’t think most of your PPP loan will be eligible for forgiveness,

- You aren’t sure your business will survive to be able to repay a loan

Whatever the reason, you may want to pay it back. How do you do that? It can definitely be confusing!

StartupNation exclusive discounts and savings on Dell products and accessories: Learn more here

EIDL loan repayment

The website you can use to repay your EIDL loan can be found at Pay.gov.

You must have your 10-digit loan number and a payment amount in order to pay it back. There is no prepayment penalty but it is possible a minimal amount of interest has accrued from the time the loan was disbursed. In addition, you’ll have to pay back the UCC filing fee of $100 if one applies to your loan. (Note: UCC-1 filings apply to EIDL loans greater than $25,000.)

Request a payoff amount before you submit your payment by contacting either:

- The Service Office listed on your monthly 1201 Borrower Statement OR

- The Disaster Customer Service Center at 1-800-659-2955 if you have not yet received a 1201 Borrower Statement

You will be able to pay by:

- Bank account (ACH)

- PayPal account

- Debit card

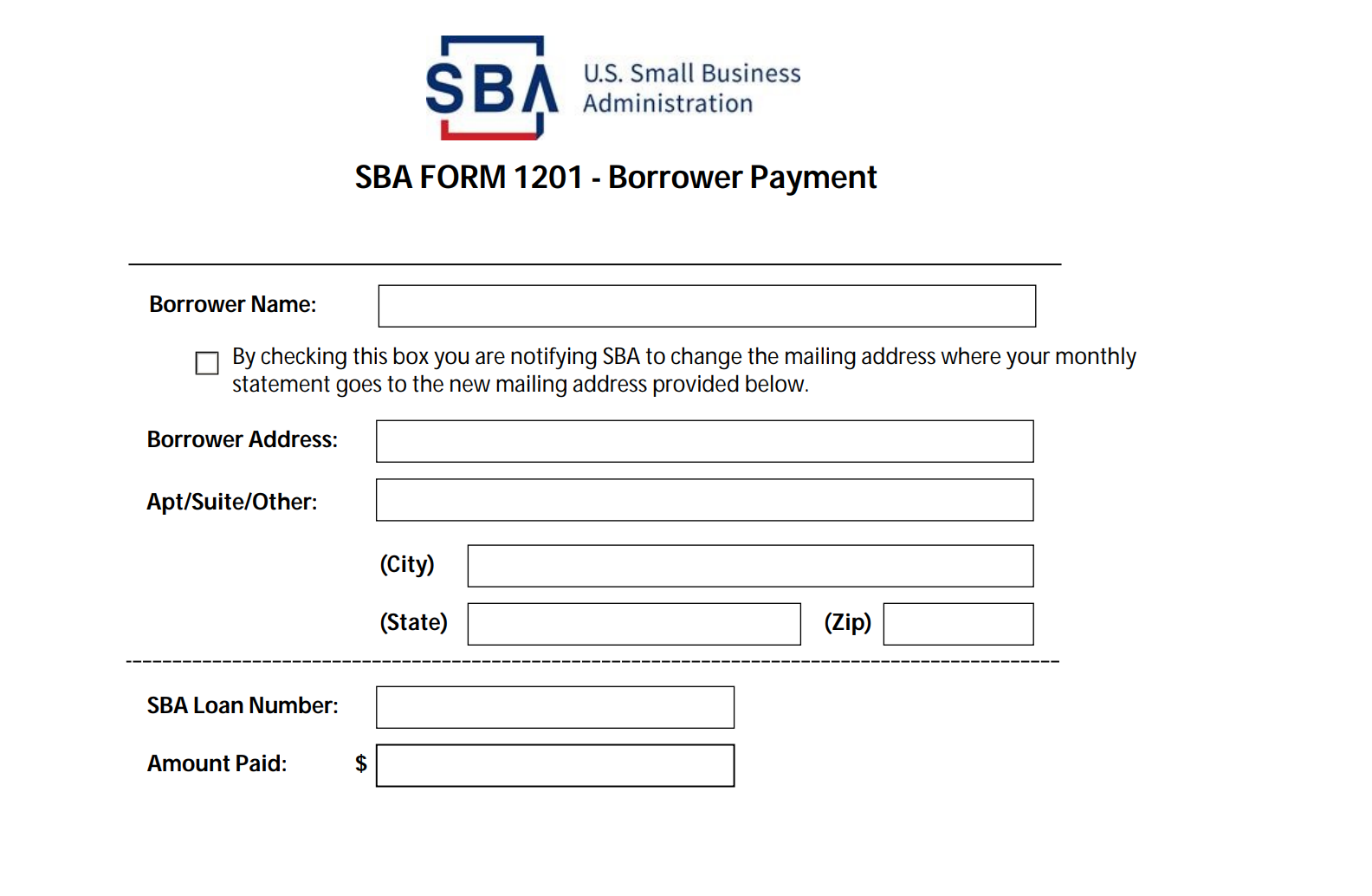

Here’s what the repayment form looks like:

Tip: Always make sure you are on the secure Pay.gov website when you make a payment! Look for the padlock in the URL bar of the page that you can click on to confirm you are on a secure site.

Keep good records of any payments you make and when you made them; take screenshots if necessary.

Note that if you did get an EIDL loan for more than $25,000, it’s a good idea to check your business credit reports to make sure the SBA releases the UCC-1 filing. UCC filings can impact your ability to qualify for other small business loans.

If you just want to pay back some of the loan early but not all of it, you’ll use the same form.

Related: 5 Ways to Make Budgeting and Strategic Borrowing Easier

EIDL grant repayment

Remember that borrowers generally don’t have to repay an EIDL grant. These grants were given in increments of $1,000 (up to $10,000) and should have been deposited into your bank account with the notation EIDG (with the “g” for “grant”). Until the IRS says otherwise, these funds may be taxable, but it’s still free money for your business.

However, if you did not fill out your application truthfully, did not apply in good faith, or you discovered your business really didn’t need the money, for example, you may want to return your grant, as well. The SBA specifies that you should not use the information above to submit a payment for an EIDL Grant. Instead, contact the SBA at 1-800-659-2955 or DisasterCustomerService@sba.gov for payment instructions.

Sign Up: Receive the StartupNation newsletter!

PPP loan repayment

Paycheck Protection Program loans were made by lenders, not by the Small Business Administration. You must pay your loan back to your lender, not to the SBA. Contact your lender to ask for instructions for returning your PPP loan.

This article originally appeared on Nav.com by Gerri Detweiler