March 2020 was a month no business owner will soon forget. The country was locking down, and our small business clients were struggling to understand the rapidly changing news cycle, a patchwork of local ordinances and vast changes to customer demand. Over the next several months, small businesses were forced to make the hard decisions required for survival. The unemployment rate soared from 3.5% in February 2020 to 14.8% just two months later as businesses slashed headcount, reduced inventory and began reimagining nearly every in-person service through the lens of a remote delivery model. In the face of extreme uncertainty, small businesses sought payment relief and access to capital wherever they could.

StartupNation exclusive discounts and savings on Dell products and accessories: Learn more here

Here’s what you need to know about how small business sectors are recovering:

PPP brought online lending to millions of small businesses

In response to these dire circumstances, the Paycheck Protection Program (PPP) was signed into law in April 2020. It immediately produced overwhelming demand. The program provided a critical lifeline for millions of businesses struggling to pay their employees, suppliers and rent. It also encouraged many small businesses to look outside the traditional banking system when seeking capital. With bank branches closed, call centers overrun and many banks struggling to provide the most basic PPP application process, small business owners went online and found success without the help of a teller or branch manager.

In total, nearly $800 billion in PPP money was provided to 8.5 million American small businesses, and nearly 30% of them received these loans from an online or non-bank lender.

Related: Goldfish Swim School CEO Shares 5 Must-Haves in Post-Pandemic Playbook

Crisis creates opportunity

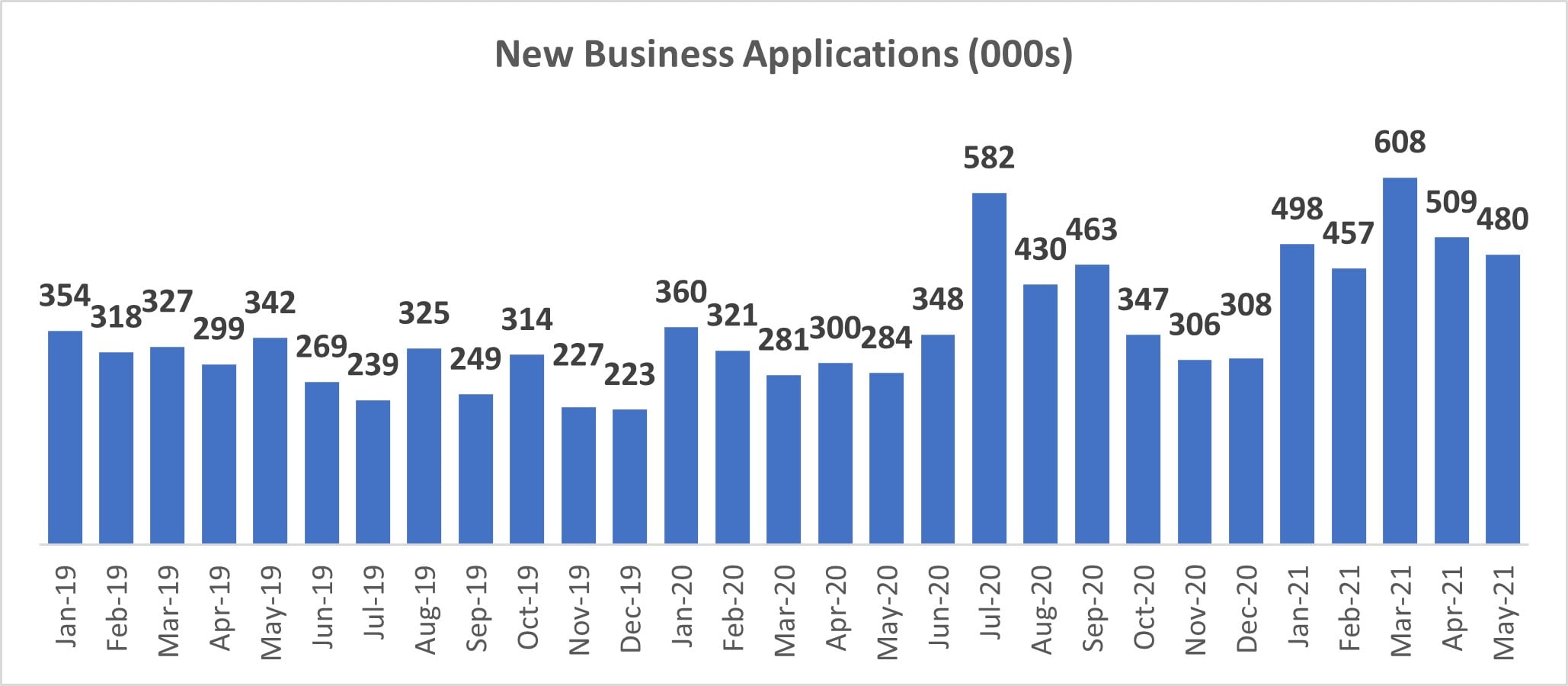

Just when the economy looked its bleakest, something fascinating and totally unexpected began to happen: new applications for U.S. business licenses began to boom. U.S. Census Bureau data shows that business applications surged during the summer of 2020 and then again in the early part of 2021, a trend that continued throughout the spring.

What is driving this increase in new business formation?

It’s hard to know for sure, but we believe it is tied to the fact that we are in a period of rapid economic and social change. Consumers are changing how they shop, how they work and where they live, creating opportunities for new and creative business models. As the pandemic hit, many workers found themselves either out of a job or out of the office, working from home with time on their hands and creative energy to burn. Government stimulus provided many with the capital required to launch a side hustle, and some of those businesses are turning into big opportunities. Many established business owners are also using stimulus money and a strong economic recovery to launch new businesses to capitalize on a changing market.

The fastest growing small business sectors

As we emerge from the pandemic, we are seeing a surge in demand for alternative lending products from these newly created businesses as well as those seasoned businesses that have weathered the storm. However, not all sectors of the small business economy are recovering evenly.

At Kapitus, we look closely at our applicant pool for signs of health across the small business landscape. What we see is that the construction, manufacturing and health care sectors are rebounding faster and demonstrating greater resiliency than the retail, restaurants and services industries. The former are applying for capital in greater numbers relative to pre-pandemic demand, and when they apply, they have stronger credit and revenue generation profiles while the latter are recovering at a slower rate. It is clear that increased demand for housing and domestic consumption is benefiting contractors and domestic manufacturers while an aging population with pent-up demand for routine health care is benefitting medical professionals more than other small businesses.

Sign Up: Receive the StartupNation newsletter!

The most popular financial products for small businesses

When small businesses apply for financing, these are the products they are most likely to consider:

- SBA loans: Variable interest rates in the mid-to-upper single digits. It generally requires a personal guarantee.

- Equipment finance: Fixed rates in the mid-single digits to mid-teens depending on credit quality. It’s secured by specific equipment and generally requires a personal guarantee.

- Term loans: Rates vary depending on credit, term and speed to funding. Personal guarantees are generally required.

- Cash flow-based financing products: Fixed finance charge paid over the time it takes a business to book sales sufficient to repay the obligation. Finance charges vary based on credit profile and strength of cash flow. Personal guarantees are not required.

- Purchase order finance and invoice factoring: Rates vary based on credit quality of the manufacturer and the purchaser of the end-product. Personal guarantees are often required.

- Revolving lines of credit: Rates start in the low teens. Personal guarantees are typically required.

Key takeaways on small business recovery

Today, those dark days of March 2020 feel like a distant memory, and we can confidently say that American small businesses have turned the corner. With more growth financing options available to small businesses than ever before, we at Kapitus are excited to help fuel the small business economy. We believe in the resurgence of American entrepreneurism and are committed to investing in its future. America’s innovators deserve no less.