On this episode of WJR’s Business Biography, Jeff Sloan unpacks the history behind Kapnick Insurance, which is celebrating its 76th year in business. What was started out of necessity by Elmer Kapnick in 1946 after a spat with his father-in-law has grown to what is now a fourth-generation family-owned business founded on the fundamental values of a deep commitment to customer service, hard work and giving back to the community.

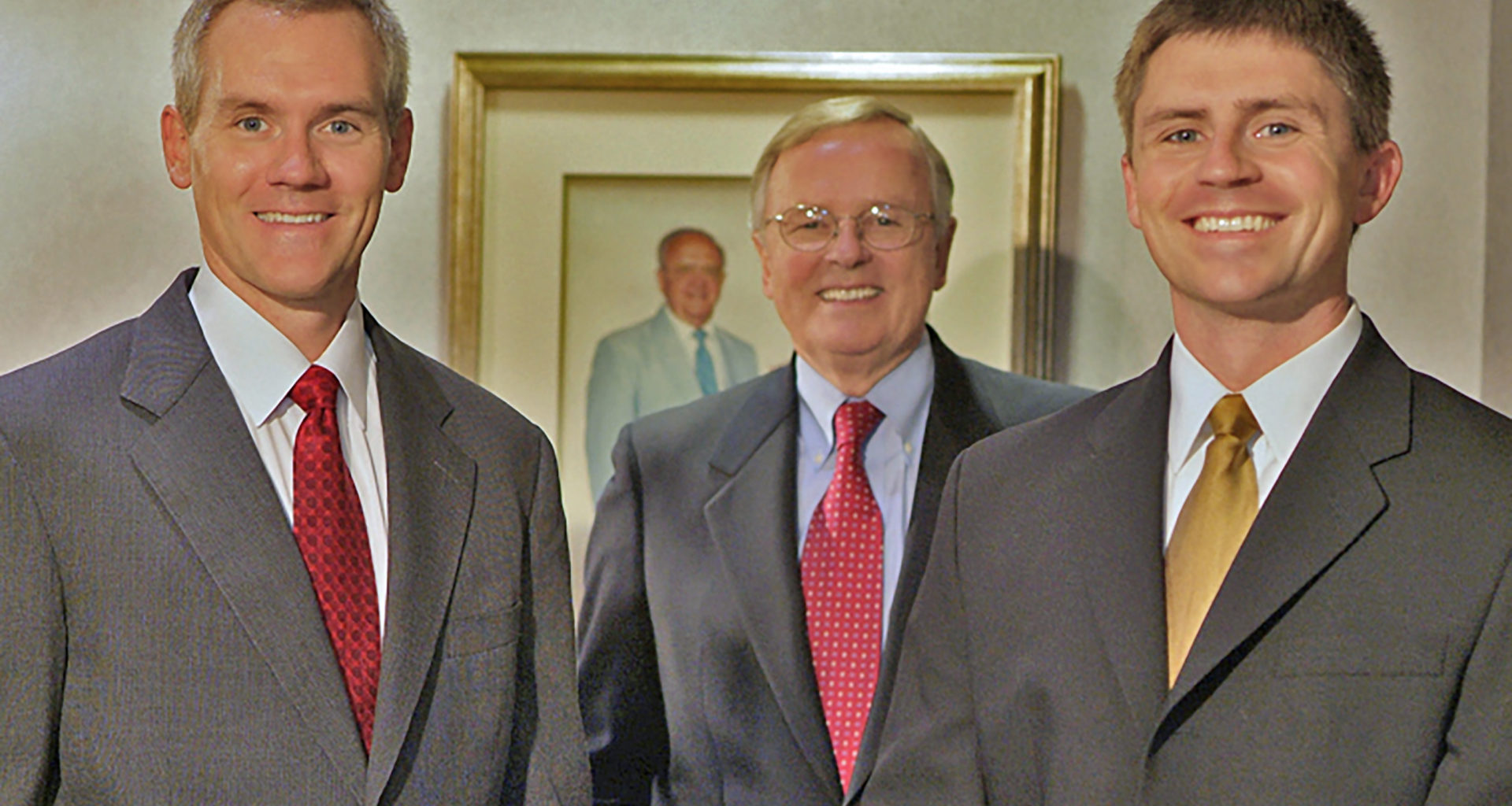

Doug Kapnick and his sons Jim and Mike trace the history of the company and its evolution fueled by niche marketing. Hear about the challenges of working together as a family as well as the business philosophies that have made Kapnick Insurance successful and resilient.

Tune in below to hear the conversion:

For more information about Kapnick Insurance Group, visit the official website, and follow on Facebook and LinkedIn.