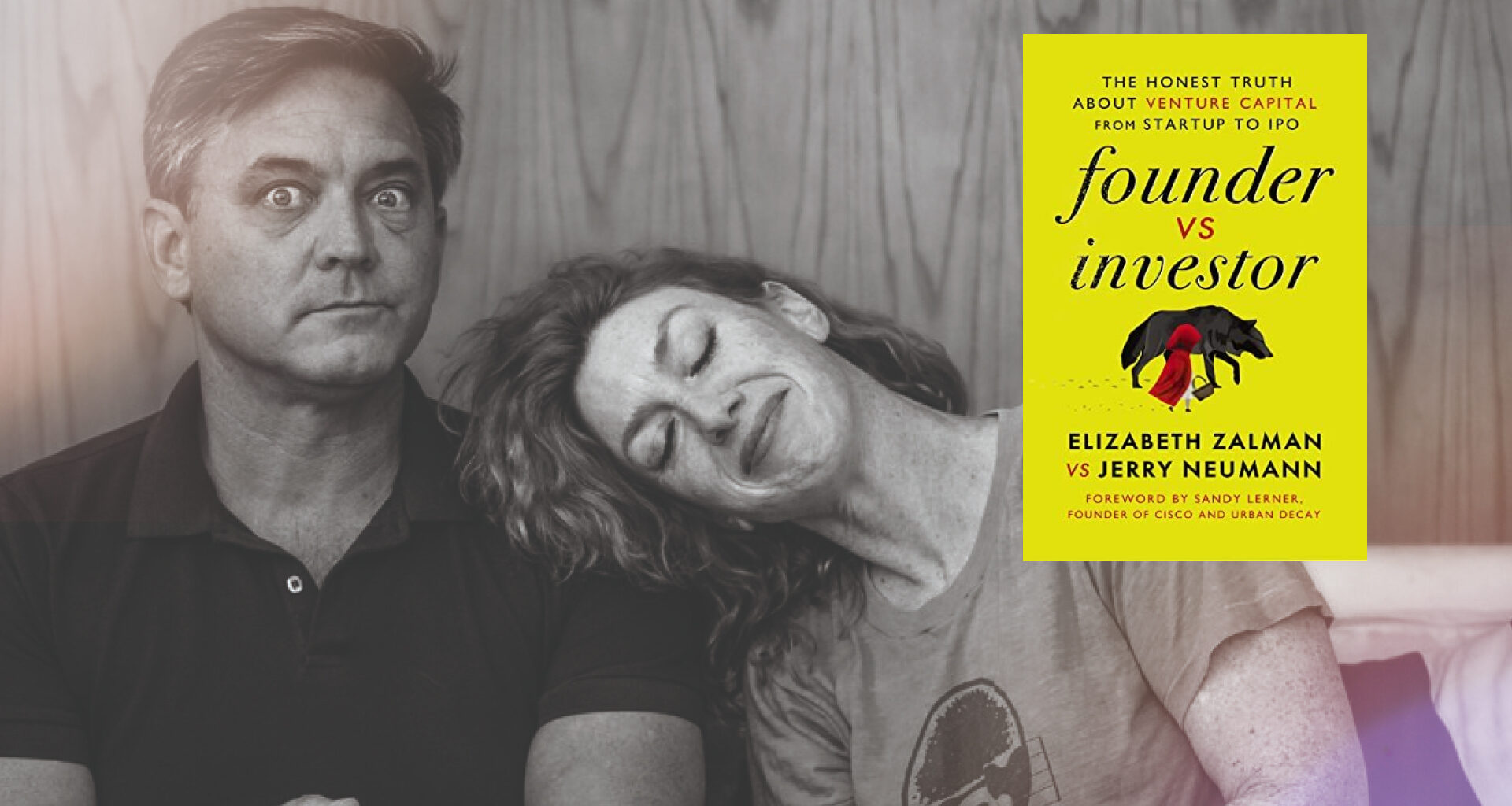

The following is adapted from “Founder vs Investor: The Honest Truth About Venture Capital from Startup to IPO“ by Elizabeth Zalman and Jerry Neumann. Copyright © 2023 by Gerard Neumann and Elizabeth Joy Zalman. Used by permission of HarperCollins Leadership.

Liz’s Absolutes of Fundraising

Rule #1: You are more powerful together as co-founders than with a hero CEO. Tag team each call. Someone pitches, someone observes and takes notes and chimes in when something isn’t hitting. The story is a dance that the two or three of you create. I have never had stronger raises than when I did it with co-founders next to me. After each call, analyze what went well, what didn’t, what resonated, what didn’t.

Rule #2: Fundraising is your new full-time job. You no longer have another job. If you’re doing it right, there are six to eight calls each day. My thirty-ninth birthday fell in the middle of a raise. That day, my co-founder and I had already pitched eight firms and I had a dinner to go to that night hosted by a fund still in the mix. I sat outside Hudson Yards crying because all I wanted was to be home alone with a piece of birthday cake, not talking. That should be you: exhausted and on the verge of tears because you are pushing that hard to get a term sheet.

Rule #3: Never talk to associates. Yes, I disagree with Jerry. You find a way to break down the door to a partner or you don’t pitch the firm. Associates can only say no, never yes. Only partners can say yes, and most often they have to get other partners to agree with them. Why would you talk to someone who is empowered only to reject you? You wouldn’t.

Rule #4: Never send a deck out over email. Yes, this is in direct contrast to my co-author. A demo video is great, but nothing more than three sentences on your business in writing. It’s the same reason as Rule #3. Why give someone the chance to say no? You, the founder, are a master storyteller. You can only control the narrative live. If someone won’t spend fifteen minutes on the phone with you to hear your story, do you really want them on your cap table?

Rule #5: Always pitch with a deck. You may be surprised that I advocate for one. I don’t with most software sales, but I do with VCs. The deck, if crafted properly, helps you control the conversation. Against the wishes of one of my co-founders, I once insisted we fundraise without one. I thought we could “just have a conversation” about the business. I was wrong and I’ll never do it another way again.

Rule #6: Never do anything without being on video (or in person). VCs like to take phone calls in their car. Don’t let them. Politely reschedule the meeting, even if it means rescheduling after they’ve joined the call from their cell. They don’t know your business, you don’t have their undivided attention, the signal will drop, you can’t read their faces. There are a billion reasons why this puts you at a disadvantage. Don’t let it.

Verizon Digital Ready: Providing Entrepreneurs the Skills and Knowledge They Need

Rule #7: Make your appearance a nonissue. Looking dowdy is the best way to ensure the focus is on the business and not you. For women, and especially women who are attractive, I’d recommend knockaround clothes. The goal is to blend in for male investors, and for female ones, you need to appear as nonthreatening as possible. For men, wear jeans and sneakers and a T-shirt. You have to look like an engineer, not a Columbia MBA.

Rule #8: Investor data requests are dumb. The term is data room, and in this case I’m referring to information you use in the fundraise to convince investors to say yes and not what is required as part of diligence before closing. These data rooms exist simply because this is an investor wanting you to do their diligence for them. They’ll each want revenue numbers a specific way, growth numbers another way, customers another way, and so on. You will kill yourself organizing information in a bespoke fashion for every investor. So don’t.

Rule #9: Always answer the question you want to answer. I live and die by this rule, even to the point where I will call out objections before they’re raised because if I do that, I control the narrative. During one fundraise, we had a weird data point that demanded explanation. We didn’t have a good answer, but instead of hiding it, we decided to call it out. By calling out the objection and reframing it, you own the narrative.

Rule #10: Pre-term sheet diligence (technical or otherwise) can drag you down. Don’t let it. We’re talking max two pitches, one call with your CTO, a few customer references, and then a partner meeting. If it’s anything more than that, something is wrong and the investor is stuck on a point. Identify that point or move on.

Rule #11: There is no such thing as “getting investor feedback.” No such thing. If you are talking to an investor, you are raising. I don’t care if it’s a fifteen minute coffee a year before the raise. You are raising. Investors will insist that “we need to develop a relationship because we only invest in founders we truly know.” They are not saying it because they want to get to know you. They are saying it because they want to (wait for it) stay as close to a deal for as long as possible so that they can defer saying yes.

Rule #12: Disqualify quickly. Or get rejected quickly. I don’t care which way it is, but get the breakup over with so you can focus on the ones who matter. A VC’s job is to string you along for as long as possible to mitigate their risk of committing capital to a failing business. Unless you’re in a frothy market or you’ve built a transporter from Star Trek, nobody is going to tell you the truth.