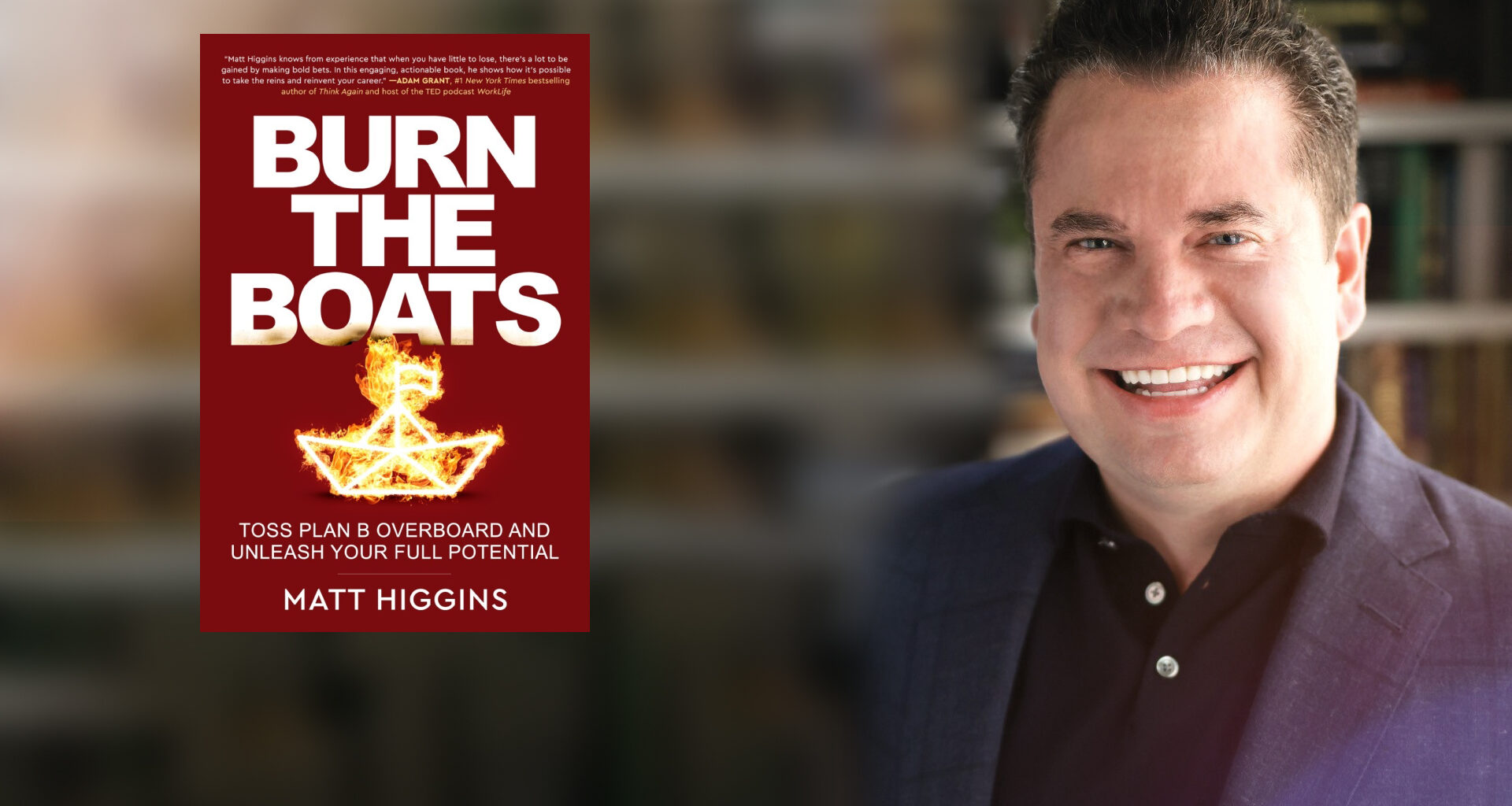

Excerpted from “BURN THE BOATS: Toss Plan B Overboard and Unleash Your Full Potential” by Matt Higgins. Published by William Morrow. Copyright © 2023 by Matt Higgins. Reprinted courtesy of HarperCollins Publishers.

The right partner—both personally and professionally—is so important. I see a particular pattern frequently: a founder assumes that because they’re new to an industry, they need someone with subject matter expertise. So they recruit a co-founder grounded in the same industry they’re looking to upend . . . but the cofounder is too steeped in the status quo to allow the company to stray far enough out of the box. The partnership gets stuck, one partner pushing hard in one direction and the other trying desperately to hold them back. This happens within established companies, too. Somebody wants to innovate, but at some point the innovation starts to feel too different, and too scary, and it’s easier for the innovator to give up than to keep fighting.

This is why control is so important to hang on to if you seek to do something truly novel. In anything we do, we have to look very closely at whether it’s a partner we need, or merely an employee with a particular skill set. I often see founders give away too much equity and power to someone they could have instead hired as an employee, rather than bringing them on as a cofounder. Yes, you might have a problem, and you might need help. But do you really need to enter a partnership that you’re going to be stuck with, even after the issue that drove you to seek that person’s help gets solved?

Lively founder Michelle Cordeiro Grant had a brilliant approach—and the confidence to stick to it—that I think about every time I see someone going down the road of partnering when they don’t necessarily need to.

“The first thing I did was write a list of all the things I was terrified of,” she told me. “What are all the spaces in the business I knew nothing about? Fulfillment, customer service, digital marketing, all of these blind spots that I needed to fill. And then I went through my network and started creating my bench, the people I could turn to if I had problems or questions. There are so many mini-moments that you have to get through in a startup. But I could bring someone in to consult as a CMO or a CFO. I could bring someone in to solve a discrete problem, and still retain control of my business. It doesn’t have to be permanent. You can test things out and see what you need in those moments.”

I love that attitude. And yet, I don’t want to make the case that you should necessarily go it alone. The data actually does show that businesses with two or more founders are more likely to become billion-dollar companies than those with just one. Eighty percent of those billion-dollar unicorns have had founding teams at the top.

When I’m looking to invest in a business that’s built on a partnership, I look for certain red flags:

- Tension tells. No one is foolish enough to reveal to an investor that a partnership is starting to sour, but if I detect subtle friction percolating into partners’ interactions with me as a potential investor, when they ought to be on their very best behavior, then what’s going on behind closed doors is surely ten times worse. Sorry—for that reason, I’m out.

- Divergent theories of change. Often there’s one partner who drove the idea, and then there’s the domain expert with experience in the space. But that domain expert needs to buy into the same theory of industry change or else it’s never going to work. If your domain expert is stuck in the traditional thinking of the industry, either afraid to do something different or not truly convinced that something different is needed, then they shouldn’t be a cofounder.

- Lack of differentiated roles. Who’s doing what, and why? Yes, complementary skill sets are subordinate to a unified vision, but if there’s overlap in expertise, or it’s not clear why each partner owns their particular domain, then there’s a flaw at the core of the partnership. Each person needs to have a reason to own their piece of the business.

- Mismatched temperaments. Companies can be like families, but partners can’t be like dysfunctional parents—where one is a pushover and one is a disciplinarian—to their employees. If the employees know that one founder is more malleable than the other, or they can pit the partners against each other, then the whole company is destabilized and exploitable. Partners need to speak with one voice and be on the same page, and not foster a situation where employees (and therefore clients and investors) know which partner will cave to their demands, and which partner to avoid.

- Misalignment of effort. Sometimes one partner is working so hard, and the other … not so much. And that’s a huge problem for any team. Just ask former Navy SEAL Curt Cronin. Before becoming an advisor to businesses and organizations around the world, Curt spent twenty years as a SEAL and is a former leader in the Naval Special Warfare Development Group. “The only reason any of us—SEALs or otherwise—can do superhuman things is that everyone knows that each person is fully invested. The moment one person hedges, no one can commit, and the flywheel stops turning.” Everyone has to be all in, or resentment builds, and things fail. I see this scenario sometimes when partners’ motives are different. One has family money sitting in the bank, and the other is much hungrier from a financial perspective, and looking at this as their big score. It never works. It’s not sustainable if everyone isn’t maxing themselves out.

When you’re evaluating potential partners, you also have to evaluate yourself: Are you going to be someone who actually values contribution from others, or is there going to be constant friction? A partner can be a great thing—but it’s only a great thing when born of necessity and not insecurity.