It should come as no surprise that launching a startup is a herculean task, especially when it comes to funding. And the task only gets more challenging when your startup is all about producing a real, physical product. Unlike software startups that are all about making code, a hardware startup has to deal with prototype creation and refinement, manufacturing, inventory ramp up, and distribution, which take financial resources, a multidisciplinary team and lots of time.

As a result, investors seek out software more often than hardware. Software was the largest category of investment for venture capital in 2015. Hardware companies received less than a quarter of the amount invested in software companies. So why exactly are investors so hesitant to invest in hardware products (i.e. real, physical objects)? And where else can an entrepreneur turn to for financing?

Why a hardware startup has a more difficult time fundraising:

- High upfront cost. Not surprisingly, there is an enormous difference in the amount of money needed to launch a hardware product compared to a software product. The market cost of launching a software product can be as low as $10,000 to $50,000, while for a hardware product, it could be several million dollars. While the cost of software production has come down rapidly in the past few years due to advancements in open source, horizontal and cloud computing technology, hardware production costs have not decreased at nearly the same rate.

- The treacherous prototype to production leap is another reason, and a process that investors watch closely. Once a successful prototype is built, the process of identifying manufacturing partners to create the product at scale begins. Investors often set funding milestones that center on “de-risking” this process. For example, you get a third of the funding at prototype delivery, a third of the funding after the first order has been shipped by the manufacturer, etc. This leaves much of the outcome out of your own hands and with your supply chain partners.

- Finally, iterating hardware is much more difficult and expensive than software. Changing a hardware product requires significantly more effort and communication than changing software code. You’ll need to work with your engineers, manufacturers, suppliers and designers to fully implement any material change.

Also on StartupNation.com: What to Know About Crowdfunding

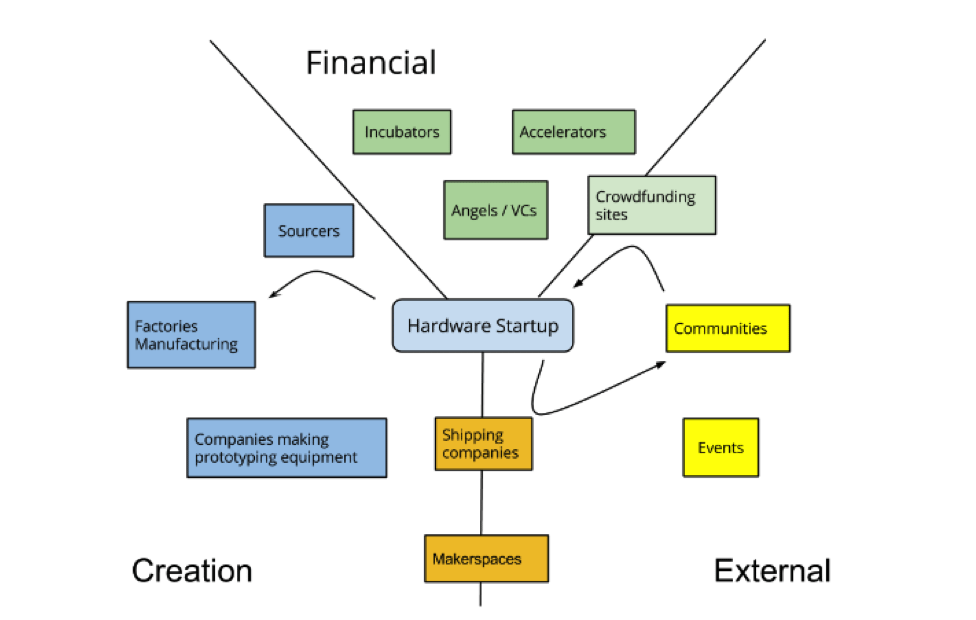

Where should hardware startups turn to for financing?

If you are looking for funding for your hardware startup, here are a few viable options to consider:

- Crowdfunding. Kickstarter, IndieGoGo and other crowdfunding sites are a great way to prefund consumer hardware products before launch. If you can generate the necessary buzz, you can also presell on your own website and avoid the fees the platforms charge. Kickstarter and IndieGoGo are the two heavyweights in crowdfunding, but key differences exist between the two, which are highlighted at Crowdfunding Dojo.

- Friends and family. Utilizing close relationships for the first $100K of startup capital is a tried and true method of getting started. Prior to asking, you should have already done market research and customer analysis to determine the demand for your product. Use this early capital to validate your product by designing a strong prototype.

- Hardware-focused funds. Despite hardware receiving significantly less investment than software, there still exist funds that are more receptive to hardware startups. In the very early stage, several funds focus solely on hardware including Bolt, Lemnos Labs, Playground and Grishin Robotics. These funds can invest pre-Seed round and are often the first institutional investor for a startup. Among traditional VCs, several brand name funds such as Andreessen Horowitz, Khosla Ventures and Google Ventures have made notable investments into hardware companies. On their blog, Bolt provides an overview of hardware investors and their portfolio companies.

- Purchase order financing. Also called PO financing, this solution allows funding of orders before they are delivered to the customer. This allows companies to take on orders that would normally be too large given their cash position. However, purchase order financing requires a fairly significant amount of diligence as inventory and orders need to be verified. This type of financing can also be quite expensive.

- Invoice factoring. If you’ve delivered the order and are waiting on payment from corporate buyers, invoice factoring becomes a useful form of financing. By accelerating payments stuck in accounts receivable, you free up cash flow to take on orders. Oftentimes, if your suppliers are demanding net 30 payment and you’re able to deliver the order to the buyer within a couple weeks, a factor can pay off your supplier within the required payment term.

- Suppliers. How can suppliers help you fund your hardware startup? By giving you better payment terms. Allowing you to pay them at a later date gives your business the breathing room to deliver on larger orders. This will be tougher to negotiate at the early stage as suppliers want to see traction before accepting longer payment terms. Also, if you have a good relationship with your manufacturer, they can help spread the upfront setup cost of manufacturing. Before a single unit is built, tooling can cost up to $200K, engineering services could cost up to $50K, with another $50K for test fixtures. If they agree to roll some of these expenses into your per unit cost, it could save a significant amount of upfront capital.