When valuations fall, pre-IPO companies need to explore new ways for motivating and retaining employees concerned about the liquidity of their underwater stock options.

Private technology and life sciences companies on the road to an IPO (initial public offering) are having a harder time securing funding. Down rounds are increasingly common, and at the same time, a handful of high-profile IPOs in the past year haven’t been able to hold their expected value as public companies.

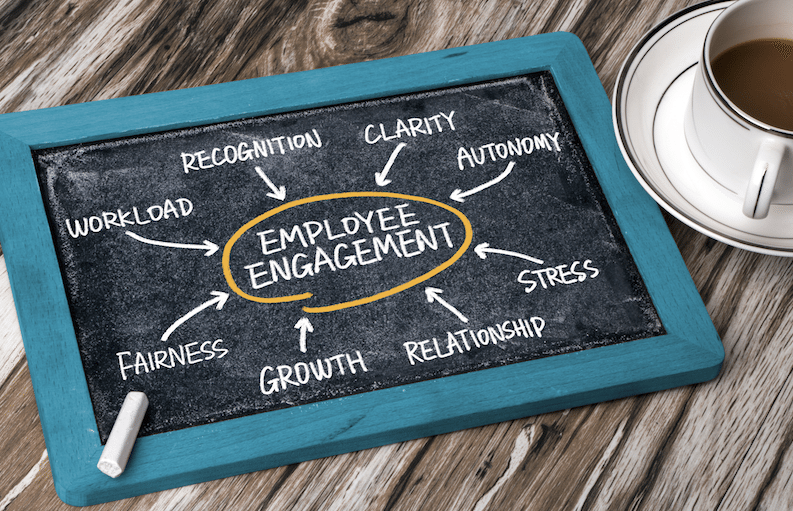

From a human resources perspective, this environment creates new challenges in motivating employees who have a large portion of their pay tied to illiquid company stock. Importantly, financing terms that ensure founders and investors are made whole upon a sale of the company at the expense of employees have been publicized in recent transactions and only exacerbate workforce morale issues.

Fortunately, there are a number of approaches pre-IPO companies can take to keep their workforce engaged during one of the most important stages in a company’s lifecycle. The most effective strategy for retaining employees may include a combination of the alternatives below.

Exchange or reprice underwater options

Employee stock options at pre-IPO companies are typically valued based on the latest round of funding. If a company goes through a down round, employees’ recently-granted stock options are likely to be underwater. There is also the chance a pre-IPO company will be purchased for less than its estimated value at the time options were awarded. The devastating impact this can have on employees has been well documented in publicized details of private transactions, such as at Good Technology. When it becomes evident that employee stock options are underwater, companies can consider repricing the underwater options for stock options with a lower strike price or exchanging them for restricted stock units (RSUs).

Replace underwater stock options with a cash payout to select employees

There are clear advantages to a cash payout: it provides immediate liquidity to employees and reduces equity overhang for investors— thus, freeing up new shares to be issued. On the other hand, pre-IPO companies tend to reserve cash for other capital-raising needs as they push to go public. Cash awards also lack a long-term retentive value unless payments are made in installments over a period of time or tied to some type of vesting event. Additionally, a cash payout lessens the retentive hold on employees.

Also on StartupNation.com: Tips for Maintaining Positive Employee Engagement

Additional equity awards

In this case, outstanding equity awards— including underwater options— aren’t cancelled, but the company grants additional equity awards. If the additional grants are in the form of options, they would typically have an exercise price closer to the per share value of the down round financing. In order to award additional equity, employers need to determine if they have adequate shares available and often may need to work with investors/shareholders to get authorization for additional shares. Additional long-term incentives can be very good for retaining employees because they will see their overall potential stake in the company increase. For investors, however, this will be dilutive, and may be viewed as a windfall to employees unavailable to shareholders.

Establish or increase existing bonus pool

This approach is in the spotlight after the CEOs of LinkedIn and Twitter donated their annual bonuses to the general employee bonus pools. Increasing the bonus pool does not require executives to leave their bonus on the table; however, doing so is a great gesture to the general employee population that company leadership values their service and is willing to make sacrifices to keep employees content and motivated. Unfortunately, not all pre-IPO companies have an annual bonus pool. Again, cash is a precious commodity for most emerging, private companies. However, even a small bonus plan can provide immediate liquidity, thus boosting morale and possibly retaining employees. The downside is that if payments aren’t consistently made, employees have less incentive to stick around at the company.

One last option is to maintain the status quo. This option should be weighed against the pros and cons of taking any of the other actions. If you don’t think your company’s value has hit bottom, or if you think your future financing rounds will be at a higher value, then canceling or repricing underwater stock options might be premature and send the wrong message to employees. As with so many compensation decisions for pre-IPO companies, timing is everything.