In the startup world, it’s pitch decks, not business plans that get companies funded. A deck is often the first impression an investor will get at the company, so it needs to look stunning. Making a pitch deck is an art, a science, but most importantly, a story.

The deck should achieve three things:

- It needs to tell your company story.

- It needs to convince the investor that they can make money with this.

- It needs to do that in under 4 minutes.

We work with founders to help them tell their company stories, so we get to see hundreds of decks and talk to dozens of companies every month.

The most common problem we see is founders getting caught up in the slides, the details and the “rules” when they focus on the story. You’ll find dozens of articles on keeping your deck to 10 slides or how you must have a board of advisers slide, but we base our thesis on some more tangible examples.

Companies like Airbnb, Intercom and Buffer have released the pitch decks they used to raise their first rounds of funding, and if you look at their structure, you can essentially find the same set of slides.

Angel investors and venture capitalists have also learned to expect a standard pitch deck as the first filter when evaluating a company to invest in. Venture firms like Sequoia have also released pitch deck templates of their own and, well, you ought to listen to them.

This is the set of slides you’ll find in those references. We’re going to use that to distill the ideal set of slides for a pitch deck (and combine it with some storytelling).

5 Terms That are Killing Your Startup’s Pitch

Storytelling 101

Who doesn’t love a good story? A story of how this team used their wits to overcome difficulties. Or a story on how everything stacked against them, and they won by the skin of their teeth.

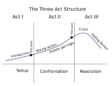

I learned this stuff in film school, and it ruined movies a little bit for me, but most stories, films included, follow a three-act structure that looks like this.

During Act I, the SETUP, we introduce the characters and the status quo. We are presented with a universe that we can believe in and invest in, as long as it’s realistic and consistent with our own experience.

Then comes Plot Point 1, around a third of the movie in. It is a point in the film where the story takes an unexpected turn, and the plot changes its direction.

In “The Social Network,” it’s when this coding, viral platform genius that we’ve been introduced to, gets presented with the Harvard Connect idea by the Winklevii and decides to steal it.

The first plot point also opens a range of possibilities of where the story could go. As viewers, we are at the mercy of the script and often have no idea where the conflict will go.

As the plot changes direction, stakes start getting higher. We care about these characters and build excitement. It all builds up to the story’s climax, which comes right after the second plot point.

Again, in “The Social Network,” the second plot point is Eduardo freezing the Facebook account: It’s another unexpected turn in the story. Instead of opening possibilities of where the story could go, it narrows them down. The second plot point is followed by the final confrontation in the story (the fight between Mark and Eduardo in the Facebook office) and the resolution.

Verizon Digital Ready: Providing Entrepreneurs the Skills and Knowledge They Need

Try placing a pitch deck story in this arc.

We start with an introduction, the status quo. What’s going on? How does the world operate today? What are the flaws?

Your solution slide is the first plot point. You are pivoting the direction of the story, you are disrupting the current status quo, and the possibilities are endless.

Now you start narrowing down. The product takes shape. Stakes get higher. We meet the hero of the story: the product.

The second plot point and climax could vary depending on your business. Maybe it’s in your traction slide because you tapped into an incredible distribution channel and are growing fast.

Maybe the plot twist revolves around the competition and how they foolishly overlooked something your team knows. Perhaps it’s about your team, your background and unmatchable experience.

It’s at that climax when the viewer is most vulnerable. It’s after that climax that you get to ask for money.

Subscribe to The Start, the Newsletter Built for Entrepreneurs

Pitch deck + story

Remember, a pitch deck is a summary of a company story. We are using slides to give arguments on why this company is incredible.

We can talk a lot about slides, slide order and story (and we will), but in the end, this is what your pitch deck needs to answer. These are the questions your pitch deck needs to answer.

- What opportunity have you discovered in the market?

- What have you built to tackle it? How does it work, and who is it for?

- How much are you growing, and will you continue to grow?

- And why are you and your team the team to change that status quo?

That’s it!

It’s easier said than done, though. We see founders getting lost on the technicalities: the market size, the business model and the projections when what you are doing should focus on answering that set of questions (in under four minutes).

So let’s combine the three-act structure with these questions.

- First, the Setup. This is the Intro, the Cover and the Status Quo question. What’s happening? Your solution slide becomes the plot point. We change the direction of the story.

- Now, Rising Action. This is your Product section: We are meeting the hero. Once we get into the market, how the market is reacting, and how big the market is, the stakes are high.

- Then, the Crisis. Your competitors and how you plan to beat them. The climax of the story. Your team, your competitive advantages, or your ingenious rollout plan are going to be the Resolution to this conflict that you unearthed.

- That’s when you get to ask for money.

How to Take Your Pitch Deck From Good to Great

Story context (and time on slides)

The term pitch deck is broad. I’ve seen it used to refer to a sales deck. You could even use it to refer to a movie pitch.

Still, there are quite a few ways investor decks can be classified. Mainly the demo day deck, the email deck and the meeting deck.

Demo Day pitch

The conditions for a demo day pitch are pretty peculiar:

- You have the founder presenting, so the slides don’t need to be self-explanatory. They are rather a support and illustration for what the person is saying.

- You have a time limit — usually 3 or 5 minutes — so maybe that rule on the number of slides isn’t complete crap.

- You are presenting in front of a large audience, which means that you should refrain from sharing confidential information. There are some regulations in the United States around what you can tell nonaccredited investors, which you are likely to have in the audience.

Email deck

Most deals happen because you get intros to investors (unlike cold emails, which is an approach many founders choose to take before exhausting their network).

When you get an intro to an investor, they will either ask you to send a pitch deck or you can ask them if they can take a look. This is the deck that gets you a meeting and probably the one that needs the most amount of work.

(The email deck is also used in other contexts: for example, when applying to an accelerator or submitting your deck to a competition.)

With that context, we can infer some characteristics about the email deck:

- It needs to be self-explanatory because the investor will consume it on their own, without your voice or narration.

- It will also be the first impression an investor will get about your company, so it needs to look stellar.

- It’s only being sent to handpicked investors, so you can reveal more of your secret sauce in it.

- It’s designed to get you a meeting so you don’t have to tell everything about the company, just enough to create attention and curiosity and get called to the next stage of the process.

Here’s an extra insight: tools like Slidebean and Docsend allow you to track the activity on your slides. So we know which slides investors spend the most amount of time on, and it turns out VCs spend an average of 3 minutes and 44 seconds on them.

You can’t assume that you’ll change people’s behaviors, so if your deck can’t be consumed in 3-4 minutes, chances are investors will skip through some of the content or just give up after a certain amount of slides. That’s why we always encourage decks that can be wholly consumed in 4 minutes.

Most Read: What Is the Average Income of a Subway Restaurant Franchise Owner?

The meeting deck

If the email deck gets you a meeting, you’ll need a meeting deck.

To me, this is an evolution of the email deck. It’s essentially the same thing, with a little extra detail.

A usual first investor meeting goes like this:

- Five minutes to settle in and small talk.

- Fifteen minutes for you to go through your slides and your company story.

- Thirty minutes for discussion, questions, follow-ups.

So as you can see, you are turning a 4-minute self-read into a 15 minute narrated deck.

Mistakes to avoid

It may be unrealistic to build and maintain three decks, especially with the insane schedules we often have to deal with.

That’s why most companies resort to making something close to an email deck and using small variations of that for everything. It’s a fair approach, and I know I’ve done it.

Still, I think you must understand the difference between these, to avoid common mistakes like,

- Taking the same email deck to a meeting.

- Using a demo-day (non-self-explanatory) deck to send via email.

- Sending a meeting deck over email, which may be overkill.

Great! Now let’s look into the structure of a pitch deck.

How to Increase Sales with a Customer Satisfaction Analysis

Structure of a pitch deck

The outline

Based on everything we’ve covered, a fantastic pitch deck outline could look like this.

Let’s go over each slide.

Intro section

Cover slide

The cover slide should have a 5-7 word description of what you do: simple, self-explanatory, so short that you read without even trying. This tagline is not a marketing tagline: it’s a very brief description of what your company does.

Traction teaser (Optional)

If you want to hook your audience early on, you can include a short traction slide that validates your company and gets people excited about what’s to come.

Remember, they are coming in without knowing the context of your business. They aren’t really sure what you do or how you make money (yet), so the information you put in here needs to be universally understood without context.

Executive summary (not recommended)

I never recommend adding one, but some decks include an executive summary right after the cover, which feels a lot like a spoiler to the rest story.

Beyond that, it forces you to cram all the slides into a single one, which sort of defeats the purpose of the rest of the deck.

Status quo section

Problem/business opportunity

Most great companies solve global problems:

- Uber solved taxis.

- Slack solved excess emails and meetings.

- Dropbox solved file syncing across devices.

There’s a bit of an aha moment if you get this slide right: if you can point out a problem that people experience regularly, that’s standing right in front of them, that’s so obvious, and yet they haven’t seen it.

This slide can also make your whole pitch fall apart when you come up with questionable statements that the investor can’t get behind. If they disagree with you about this premise, then you might lose them here.

For example, I’ve come across a fair share of social media startups that begin their problem slide by saying current social media is boring. That’s an opinion, not a fact. You don’t want to get into an argument at this point.

Some companies aren’t necessarily solving a problem but instead tackling a business opportunity that has arisen. Examples here are mobile games, which certainly don’t solve a problem; they are just jumping on a business opportunity they discovered.

Solution slide

Think of the solution slide as a mirror to the problem slide. Remember: This is the plot point. This is when you break the status quo.

Great solution slides are also concise. They don’t involve technology or features; it’s not time to talk about the product yet. We are presenting our thesis: what if instead of doing things like this … we do things with this new approach.

There’s some elasticity here, depending on how complex your product is or how much time you need to reserve for the next sections.

Product slide

You can approach the product slide as a (short!) video demo, a how-does-it-work diagram, or even a series of product screenshots. These slides will probably not be too different from your marketing landing pages; you can probably get some inspiration there.

Feature/benefits slide

I like to keep this to five or six benefits tops and notice how I use the word benefit instead of feature. A feature would be: Slidebean is fully responsive. A benefit would be: Edit your presentations anywhere, even on your phone, while on the go.

By removing the jargon and adding a real-life use scenario, the statement becomes more impactful.

Audience/use cases

You’ll see that this slide is not included on any of the decks we analyzed, but I think it’s a critical slide, especially if you are a Seed or Series A company.

The idea of this slide is to prove that you understand who the product is for. So many companies don’t know the answer to this question, and that is a common deal breaker.

Infrastructure/underlying magic (optional)

For products with a strong technological component, or when the tech infrastructure is one of their core differentiators, it’s also relevant to include an underlying magic slide.

Top Startup Leaders Offer Marketing and Branding Secrets

Market validation/why now (optional)

A market validation slide is included to support products where adoption could be a challenge. For example, on their 2009 pitch deck, Airbnb had a market validation slide to support their thesis that people would be willing to stay on strangers’ couches.

Business model

This is one of the easiest slides to solve and one of the slides that many entrepreneurs get wrong. This slide is not about projections. It’s not about how much money you could make if you get 1 million customers. It’s just about how you make money.

Is it a subscription? You don’t need to lay out every single plan and its ins and outs. In my experience, that should be changing regularly as you experiment with different combinations: just tell us a $$$ subscription, with or without trial. Done.

Is it a product or a service? Tell us what the price is, or maybe the average order size, and give us an idea of the margin. Is this a 30% or a 60% margin product?

Is it a marketplace? What % do you charge per transaction? 10%. Done.

Milestones & road map

I think this slide functions as an excellent bridge between the product, what it is, how much it costs … and what’s coming in the next section, which is the numbers and the traction.

To me, an ideal road map slide goes over some of the major highlights in your product evolution and your company history, and then it talks about what you intend the product to become, again, over the next few months.

We are not making financial projections yet. This is the product section so we are talking about product vision, not numbers. Don’t get revenue projections mixed in here.

Market section

Traction

This is a slide about numbers. Think of a number as a photo and a chart as a story, a film. Saying that you’ve made $1M in total revenue sounds cool, but what we want to know is your journey getting there.

How much of that revenue came in the last month? How much was that month compared to the previous one and the one before that? What breakthroughs did you make that completely changed the inclination of that chart?

There’s no faking a traction slide. It is what it is, and that’s why it’s so important.

Go-to-market

How will this money that you are about to raise accelerate your growth? We can answer this question by covering these parts:

- What have you done to get here?

- What are you doing that shows promise?

- What are you going to do next?

Remember, rounds of capital usually fund 18-24 months’ worth of operations, so we are looking for a growth plan: a marketing plan of how you will get the company to the next fundable milestone.

The most common mistake I see on go-to-market slides is lack of focus. I can’t count the number of go-to-market slides that say “We will do social media, SEO, and influencer marketing.”

That’s what everybody is doing. It doesn’t make you unique. It makes you generic. A great go-to-market slide talks about two, maybe three, concrete channels that you are using to grow your customer base and that you will continue to use.

Market size

In the previous slide, we already talked about how big this company is getting over the next year. Now it’s time to answer, how big does the company get, total!

The concept of that is TAM or Total Addressable Market, but it’s a bit foreign to many of us. What does TAM mean?

Using a SaaS (Software as a Service) example, your market is not THE SaaS Market. That’s a $200B+ market these days, but it doesn’t matter to you how big the SaaS market is. Saying that you’ll own 1% of the market is just an oversimplification.

Your TAM is also NOT the size of the problem. For health care startups, for example, it’s not the amount of money wasted on X or Y process that you are solving. You are not earning that money, and your company is not worth that. You’re solving the problem and charging a fee for it.

Startups are exciting to investors if their TAM is, at least, in the hundreds of millions of dollars. Again, it’s not about inflating your numbers. It’s about this self-assessment: is my company potential significant enough to get investors excited?

Why us

Competitors

You can approach this as a simple business grid chart, a table comparing features or a simple summary of your core competitors.

Competitive advantages/secret sauce

When you talk about competitors, more than comparing features, more than comparing what your pricing is, it’s about showing that there’s something that you understand about the market that others don’t seem to get.

That’s what makes great companies: unique insights that you have discovered that these established competitors haven’t figured out yet.

Team

The founding team on a startup needs to have the skills to get the company to $1M in revenue.

If you are building an app, getting to $1M in revenue requires marketing, development, user experience (UX), and business/operations. If you are building a B2B SaaS platform targeting enterprise, you need engineers, business development and sales.

I can’t count the number of decks I’ve seen where the current team doesn’t have the necessary skills to reach scale. You don’t raise money to recruit people: you form a team, and then you raise money.

Advisers (not recommended)

Unless your investors know who the adviser is (i.e., either they are a celebrity or the investor is connected with them on LinkedIn), I wouldn’t waste any space on them. Advisers are great, they are helpful, but chances are they’ll spend one or two hours a month working with you.

This company is going to be built by its team. That’s the people we care about.

The ask

Financial

The financials slide is straightforward:

- If you’ve been operating, we want to see the last financial year of data; and then, for everyone,

- 3-5 years of financial projections for your company.

Founders typically add a simple table with their SG&A, COGS, CAPEX, and revenue with a final profit margin and percentage number, requiring you to do some financial modeling. However, that’s an article for another day.

Fundraising/use of funds

The fundraising slide should cover how much money you are raising and be super clear about that next fundable milestone we have talked about.

A Seed round is supposed to last until a Series A. Closing a round takes about six months, so this round should last enough for you to get to Series A status, plus an extra six months to complete that round.

You’ll see a lot of decks that talk about how this round funds 18 months of operations, and that’s not necessarily a bad slide, as long as the math behind that number responds to a fundable milestone. It’s not about time. It’s about metrics.

Conclusion

That’s a lot of information to process, and figuring out some of these slides will require you to sit down and iterate time and time again.

A good sanity check after you finish each iteration is to go back to those questions:

- Is this deck telling your company story?

- Can investors make money with this business? Can the company grow enough for that to happen? And finally, if you are sending it over email,

- Can the deck be consumed in under 4 minutes.

We do videos on this process all the time, there are a lot of free resources on our blog. If you want some help from our team, check us out at slidebean.com.

StartupNation exclusive discounts and savings on Dell products and accessories

Originally published Nov. 22, 2021.