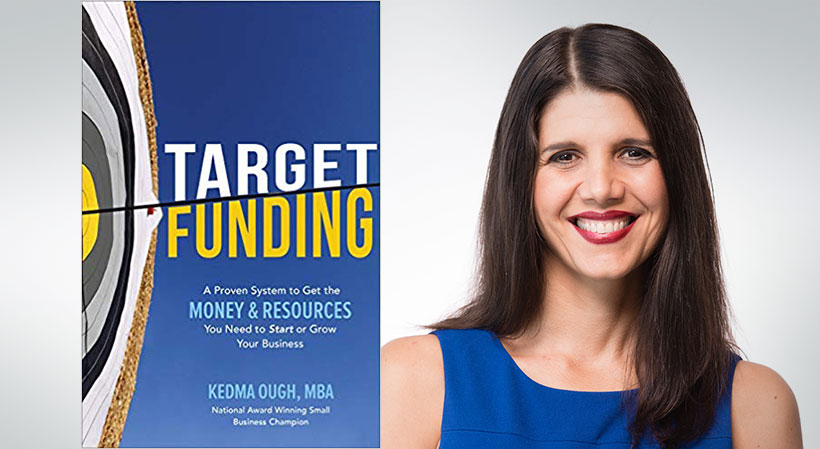

The following is excerpted from “Target Funding: A Proven System to Get the Money and Resources You Need to Start or Grow Your Business,” pg. 26 to 28 (McGraw-Hill, July 12, 2019).

If the vast majority of early-stage entrepreneurs, small businesses, and independent inventors can’t get conventional business loans or venture capital, where do they find the funds to start up, scale up, or shore up their businesses?

According to the latest surveys of the U.S. Small Business Association (SBA) and the National Small Business Association (NSBA), 82 to 85 percent of startup funds and 45 to 48 percent of expansion or stabilization funds come from the respective business owners and their family and friends. More than three-quarters (77 percent) of initial and early-stage funding comes from the owner’s (or inventor’s) personal savings, with the remainder coming primarily from personal credit cards, home equity loans, and selling personal assets.

But what about the 30 percent of small business owners who have few personal assets and a less-than-ideal credit rating? And what about those who manage to raise their own and even outside capital, but it falls short, leaving their business undercapitalized and unable to realize its potential? How do all of those people fund their businesses and bring their inventions to market?

Related: 3 Often Overlooked Funding Sources for Startups

Having been in that position myself and having helped thousands of businesses in that position, I can tell you how: they find creative ways to fund their ventures. You can, too! And I’ll show you how.

Regardless of whether your business is “bankable” and “investment-worthy,” I encourage you to look into alternative options and to go after those that are right for you before, if not also instead of, seeking credit financing or equity financing. The more you get for free or at reduced cost, the less money comes out of your pocket and the better your ability to manage cash flow. The fewer equity shares of your company are held by others, the higher your percentage of your company’s profits and the more control you have over your business.

I also encourage you to broaden your concept of funding to encompass more than money. Your strategy should include not only the money you raise, but also the money you save by getting the resources you need (materials, equipment, space, professional services) as a gift, in trade, or at a discount.

At its most basic, all business funds comes from one or more of the following:

- You, the business owner or inventor (self-funding)

- Donors (gift-based funding)

- Lenders (debt funding)

- Investors (equity funding)

What most people don’t realize is this: There are multiple funding options within each of those four funding types, and you’ll usually find multiple funding sources of each option. Sometimes the best opportunities for most startups, small businesses, and independent inventors are alternative forms of funding—all of which are actually specialized forms of self-, gift-, debt- and equity-funding.

For example, self-funding may come not only from your retirement and 401(k) funds but also (or instead) from bootstrapping, bartering, and cooperatives. Gift-based funding may come not only from family and friends but also (or instead) from matched savings grants, awards from business competitions, crowdfunding, no-cost or low-cost professional services, and grants from government agencies, business incubators and accelerators, and community organizations.

Sign Up: Receive the StartupNation newsletter!

Likewise, debt-based funding may come not only by way of commercial loans from banks but also (or instead) from SBA-guaranteed loans, interest-free loans, revenue-based loans, micro-loans, nonprofit community lenders, online lending platforms, and “niche” lenders that focus on a specific demographic or type of business. Equity-based funding may come from crowdfunding, angel investors, and “boutique” venture capital groups that specialize in companies in a certain industry, certain location, or founded by entrepreneurs of a certain ethnicity, gender, or socio-economic disadvantage.

You will learn about the various funding options for startups and small businesses as you read (the) book. What’s more, you’ll learn which ones are aimed at entrepreneurs like you and ventures like yours.

“Target Funding: A Proven System to Get the Money and Resources You Need to Start or Grow Your Business” is available now wherever books are sold and can be purchased via StartupNation.com.