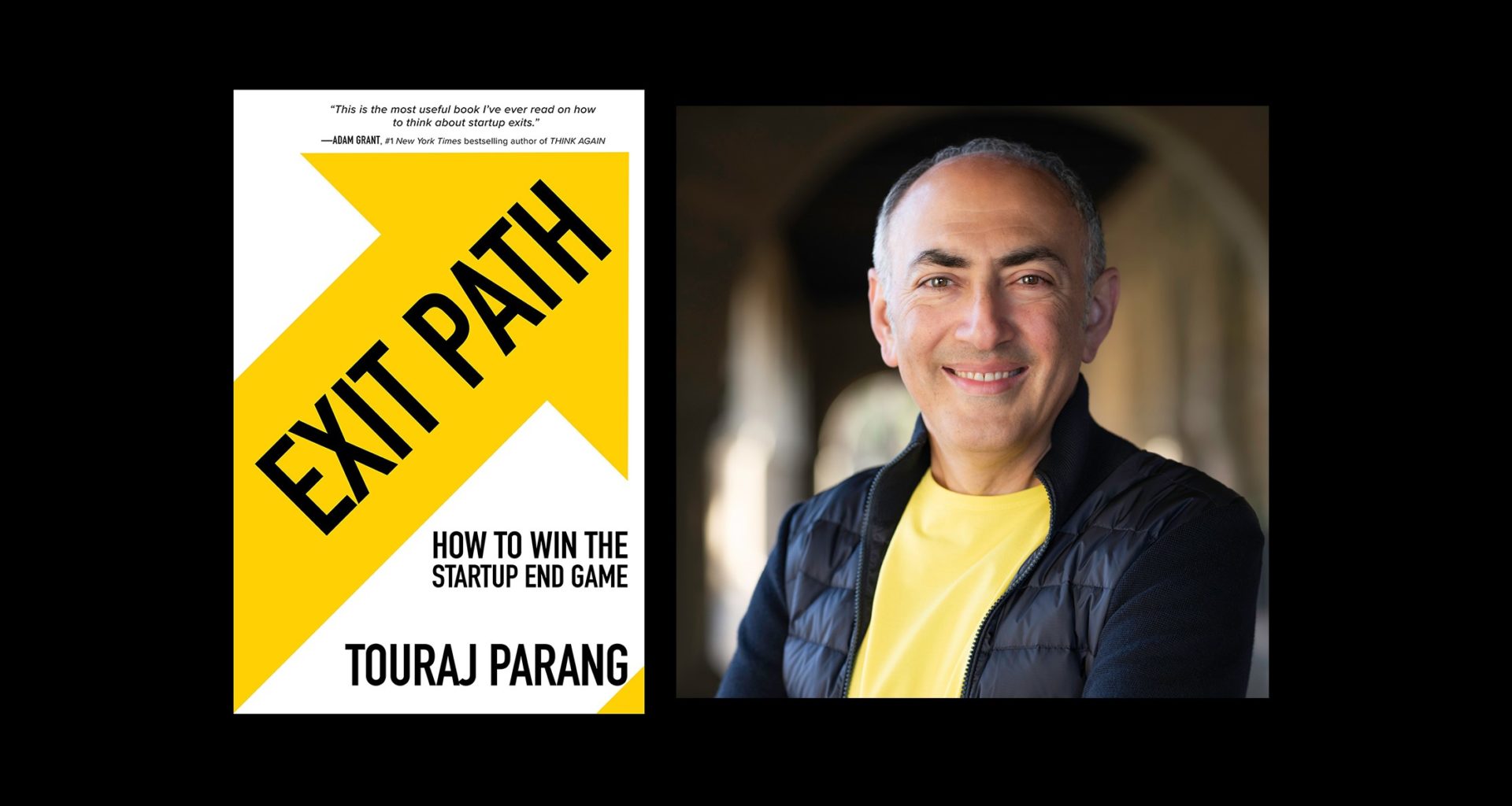

The following is an excerpt from “Exit Path: How to Win the Startup End Game” by Touraj Parang. Copyright 2022 by McGraw Hill.

RATIONALE AND TIMING

Plans are worthless, but planning is everything.

—Dwight D. Eisenhower

Selling your startup is unlike any other business transaction you have been involved with. Preparing for the sale of your startup as yet another business negotiation is like preparing for a NASCAR race by practicing at your local go-kart track: in both cases, there will be blood—your blood. The difference in what is needed to prepare for either is not merely a difference of size, but also a difference in kind. The increased size of the vehicles and racetracks in NASCAR necessitate an entirely different set of driving skills and years of physical and mental conditioning to survive, let alone succeed. Similarly, although it is certainly helpful to be a skilled negotiator when you are in acquisition talks with potential suitors, a decent outcome requires months, even years, of advance strategizing and careful preparation.

Just as “location, location, location” is the age-old advice for success in real estate investing, “preparation, preparation, preparation” is the well-kept secret of savvy dealmakers. At its most fundamental level, a successful exit only happens if you manage to tie the knot with the right acquirer, at the right time, and with maximum negotiation leverage. Unless you are supernaturally lucky, you actually need to create a plan and work on it to orchestrate the perfect confluence of these events. They won’t spontaneously come together in a chance encounter with the perfect acquirer. While many human marriages result from serendipity, corporate marriages don’t; they require careful advance planning. Without a plan, how would you even know who is that right acquirer, when is the right time to sell, and what are the right terms? While your starting plan will most likely not get everything right, the framework and general direction resulting from the planning process itself is the key to success.

At its most fundamental level, a successful exit only happens if you manage to tie the knot with the right acquirer, at the right time, and with maximum negotiation leverage.

Exit planning starts you on a journey to discover your goals, aspirations, and hypotheses and to assess your startup’s current position in relation to those. Most important, it forces you to define what success would mean for you and your stakeholders. To know who could potentially be the right acquirer for you, you need to define your criteria for evaluating acquirers and then assess who could actually meet them. To have any idea as to when is the right time to sell, you will need to become clear on the goals for your startup, your timing to achieve them, and where along that trajectory you think you would both be willing to sell and have a strong negotiation position. All of this soul-searching and market research activity needs time and iteration to yield meaningful results.

No matter how nascent or established your startup is, your exit planning should start today. To understand why, let’s step back and distill an acquisition down to its core essential components:

- A willing buyer

- A willing seller

- A set of terms everyone agrees with

Each of these three ingredients needs time to manifest. A buyer’s willingness to do a deal needs to be cultivated over time. Similarly, you and your critical stakeholders also need to be far along on the journey to clearly see how an acquisition fits within the arc of the narrative for your startup. And finally, neither you nor your acquirer would settle for a set of terms that are not aligned to each side’s ultimate corporate goals and objectives. It takes time to uncover what yours and your desired acquirers’ ultimate objectives are and how you can best align them.

Regardless of the size of the transaction, for you as the selling entrepreneur and your startup, an acquisition will be a transformational and life-changing experience. Your exit may very well change the career or life trajectory for your employees, could delight or frustrate millions of customers, might shift the competitive dynamics of an industry, or perhaps much more. To ensure that the end result meets your expectations as much as possible, you need to have done your homework. Just as having a business plan is a great way to prepare and create the blueprint for the business activities of your startup, an exit strategy is a great way to prepare and create the blueprint for the strategic activities of your startup. In fact, a business plan without an exit strategy is only half complete as it leaves unanswered many important strategic questions about the ultimate fate of your startup—the “who,” “why,” “when,” and “how” of an eventual exit.

The exit strategy creation process laid out in the following three chapters follows these basic steps in sequence:

Step 1: Gather. You and the team need to align on a realistic picture of your place in the market, and grounded in that reality, brainstorm on your go-forward strategy.

Step 2: Document. There is no plan unless it is written down. You will need to memorialize the results of your research and brainstorming sessions in an accessible format. This will become your exit strategy.

Step 3: Iterate. Just because you write it down, of course, doesn’t mean you can’t revise it. A good exit strategy, just like a good business strategy, needs to be constantly revisited and revised in light of observed, real-world data.

The right process will take you a long way toward arriving at the right outcome.

If these “basic” steps seem to entail a lot of work, that is because they do. I call them basic in a similar vein that walking is basic. Learning how to put one foot in front of another while maintaining our balance took the good part of the first year or more of our lives. Devising an exit strategy will demand diligence, patience, and attention. It will take some of the valuable resources of your startup, especially time and focus. Therefore, it is critical to recognize that without the right process and diligent follow-through, it would be a waste of time.

If you are wondering whether such somewhat elaborate process for creating an exit strategy is worth the effort, you are in good company. I used to have many reservations about structured strategy activities myself. But over the years and many trials and errors, I have come to realize that following a formal and thoughtful process actually makes a tremendous difference in the outcome. In a study conducted by management consulting firm McKinsey, researchers found that 79 percent of executives whose companies had a formal strategic planning process were satisfied with their approach in contrast with only 49 percent satisfaction for the companies that didn’t have such formal processes. The right process will take you a long way toward arriving at the right outcome.

In the following chapters I will lay out a structured process for you to create an exit strategy, drawing on expert research along with my personal experience working with various teams over many years to formulate and implement strategic plans, including exit strategies.