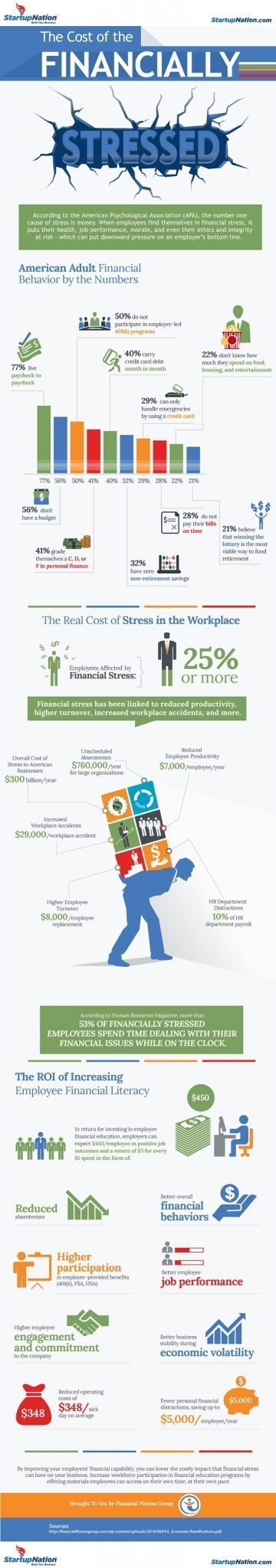

A staggering 80 percent of American employees experience financial stress, and these financial troubles cast a wide shadow, often taking a costly toll on employers, as American businesses lose an overwhelming $300 billion per year due to stress.

Poor financial health stems from a lack of good financial habits and knowledge. Fifty-six percent of employees don’t maintain a budget, and Americans feel woefully underprepared to manage their finances. When asked to grade themselves in personal finance, 41 percent of people give themselves a C, D or F. The effects of stress seep into the workplace, costing employers over $800,000 per year due to decreased productivity, unscheduled absences and distractedness.

The good news is that employers can play a huge role in promoting financial wellness. The positive effects of investing in financial education add up to an average ROI of $450 per employee. Improving the financial stability of just one employee can save $5,000 per year. There’s really no question: financial literacy programs are good for your team and good for your bottom line.