Millennials are proving to be a unique generation when it comes to economics and finance. A passionate generation, millennials value meaningful work that gives them the autonomy and freedom to make their own decisions.

Some millennials reach for this sense of purpose by working for corporations and non-profit organizations that align with their goals. Meanwhile, the pioneers of the millennial generation are entrepreneurs who are not afraid to take calculated risks to win big by starting up on their own.

The entrepreneurial spirit is strong with millennials, and 2018 has been a good year for millennial-led startups. By and large, millennial entrepreneurs expect their companies to grow enough to hire more full-time employees before next year.

Interestingly, the calculative attitudes of millennial entrepreneurs seem to have carried over to the rest of the generation. Millennials understand the risks of the market, so they are heavy savers.

How do millennials’ entrepreneurial attitudes shape their decisions? Let’s take a look at what makes this generation different in financial markets.

Related: 8 Best Practices for Marketing to Millennials

Millennials are saving for business and near-term payoffs

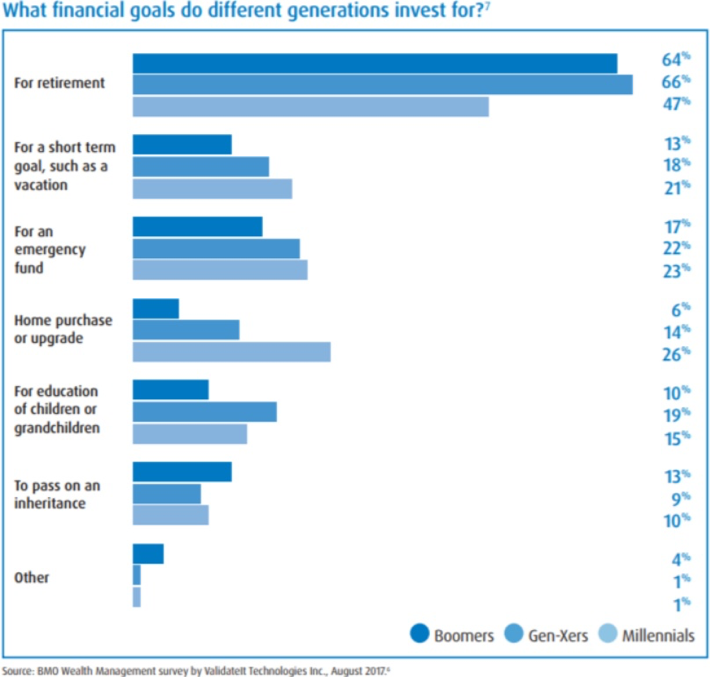

BMO Wealth Management conducted a study to discover the reasons for saving and investments by different generations. Unsurprisingly, baby boomers and Gen Xers reported that their primary financial goal is to save for retirement: 64 percent of people over the age of 55 save mainly for retirement, and an even larger percent of Gen Xers stated that retirement is their goal for saving.

Millennials are different, as just 47 percent of people between the ages of 18 and 34 are saving for retirement. This age group prefers to save for short-term goals like vacations, large upcoming expenses and meaningful business endeavors that will help grow their companies.

A recent survey discovered that 29 percent of millennials plan to use their savings and investment returns to support work that they enjoy.

The results of the BMO Wealth Management report are not surprising. Older generations will naturally be focused on retirement, while millennials dedicate their energy and resources to impactful missions. Some may be quick to conclude that millennials are simply short-sighted when it comes to financial goals. After all, conventional financial wisdom suggests that people should begin investing early and hold onto their assets until it is time to retire. This is good advice, but a large minority of young people feel that they can better themselves by seeking some near-term payoffs. Positive impact or business returns from a startup can lead to a life well-lived.

Young people may have unconventional financial preferences, but they are phenomenal savers, as millennials save twice as much as baby boomers: 45 percent of millennials save at least 10 percent of their income each month.

Millennials calculate the risks of investing

The general rule for long-term investing is to buy and hold. When the markets take a turn for the worse, buy more stock. Interestingly, just a large minority of millennials (32 percent) use this strategy.

Instead of buying and holding, millennials prefer to save their money before weighing the costs and benefits of various investment options. This behavior is typical of a successful entrepreneur.

Unfortunately, many millennials are overstating the risks of the stock market. Two-thirds of millennials do not have a 401(k). The S&P 500 has demonstrated a long-run trend of positive growth for its entire history. What are millennials afraid of? The obvious answer is market losses, but it is possible that young professionals do not trust Wall Street.

Though it may be unwarranted for the current times, the distrust of Wall Street is reasonable. Millennials began entering the labor force during a time when economic outlooks were glum. The millennial corporate disgust could also be driving young people’s desire for autonomy and meaning in their work, leading them to start their own business.

Sign Up: Receive the StartupNation newsletter!

Millennials are flocking to alternative assets

What is clear is that millennials are moving their money to stock market alternatives. In a survey carried out by LendEDU, 15.1 percent of millennials responded that they would invest a $10,000 gift in real estate markets, and 9.2 percent of millennials stated that they would purchase cryptocurrencies such as bitcoin.

Young professionals and entrepreneurs may remain cautious while using the markets to their advantage, but this generation of entrepreneurs is one that is unafraid to take calculated risks in order to win big by starting up on their own.