In 2021, investors gave startups a record-breaking $621 billion globally. This is more than twice the amount from the year before.

Money is the lifeblood of a company. Without it, you cannot pay employees, build inventory, purchase equipment or market your product.

That isn’t to say that you cannot bootstrap a successful startup without any outside funding. Take Mailchimp, a well-known bootstrapped company purchased by Intuit in 2021 for $12 billion, as a prime example.

However, most companies require significant external capital to get their business started. So how do you get a slice of that $621-billion pie?

In this post, we’ll discuss what every startup should know before reaching out to potential investors and how to choose the right investor for your company.

Let’s dive in.

1. Understand your funding needs

When deciding whether to reach out to investors, there are a lot of factors that come into play. Before you get too far into the process, it’s important to consider why you need funding and what you plan to do with it.

An important question that many founders don’t ask, says Preetam Nath of DelightChat, is “Do you need funding? And if yes, what is the objective of this funding? Is it to get to a milestone to raise the next round, or do you intend to become profitable and grow sustainably? It’s very likely that your company could grow profitably with just one funding round. That’s a real option that many founders don’t consider.”

Have you reached product-market fit? If not, what do you need to get there? Do you need cash to purchase inventory? Pay or hire employees? Or conduct product research and development (R&D)? Whatever the reason, make sure you have a solid plan in place.

Of course, no funding is free. When you receive money from investors, you’re giving up a part of your company. It’s crucial to determine if raising funds for your business is appropriate. Are you willing to give away 10% of your company? What about 20%?

Also, don’t expect to receive any cash unless the investor has clear financial benefits. Investors want to generate the largest return on their investment (ROI) possible.

If your company is ready to scale up but needs more funds than it has available — or if your business model isn’t yet profitable — then reaching out to investors might be the right move for you.

2. Make sure your team is on the same page

Before you start reaching out to investors and building your pitch deck, you’ll need to consider how the legal entity structure of your business plays into raising capital.

For example, a single-member LLC has one owner with full control over the business. They can choose to bring on investors without consulting any other parties. Conversely, a partnership will have two owners that need to make one cohesive investing decision. And a corporation may have a board of people who need to be consulted before any financial decisions can be made.

Taking on investors is a big decision. Plan accordingly, and allow ample time to come to an appropriate conclusion. Don’t wait until the last minute to get your partner on board.

The last thing you want is to create a divide ahead of such a significant business milestone. It should be the cause for celebration and not destruction.

3. Research recent industry activity

One of the most important things you can do is learn about the types of investments that are active across your industry. You can gain intel by looking at other recently funded companies and learning how those deals were structured.

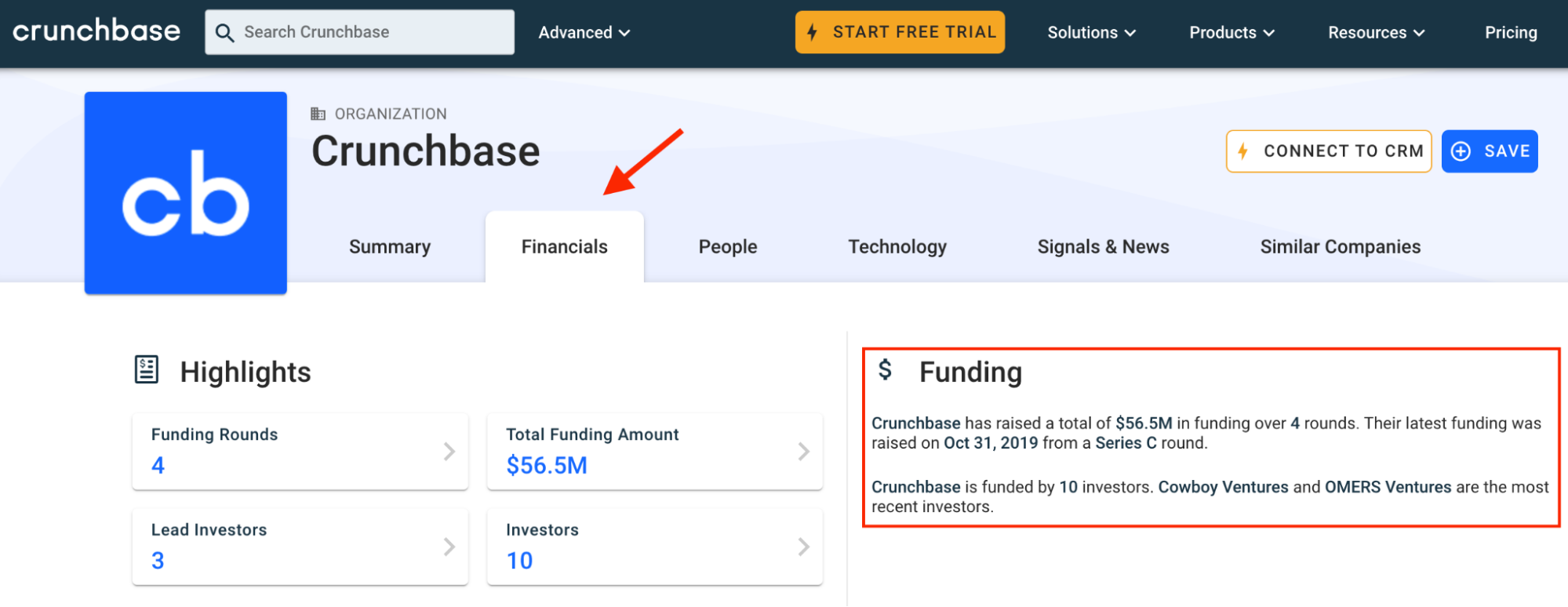

You should also note what investors are getting involved with these deals and what type of investment rounds are taking place. Crunchbase is a free and easy tool to help you during your research.

The knowledge you gain from this research stage will help guide your communications with potential investors when it comes time for your own funding endeavors.

Assaf Cohen, who runs gaming company Solitaire Bliss, explains, “When we raised money, we showed to all our investors how much money was going into the gaming space, and the exit multiples and valuations when these companies were being sold. This played a huge role in convincing investors to believe in us.”

4. Determine your ask

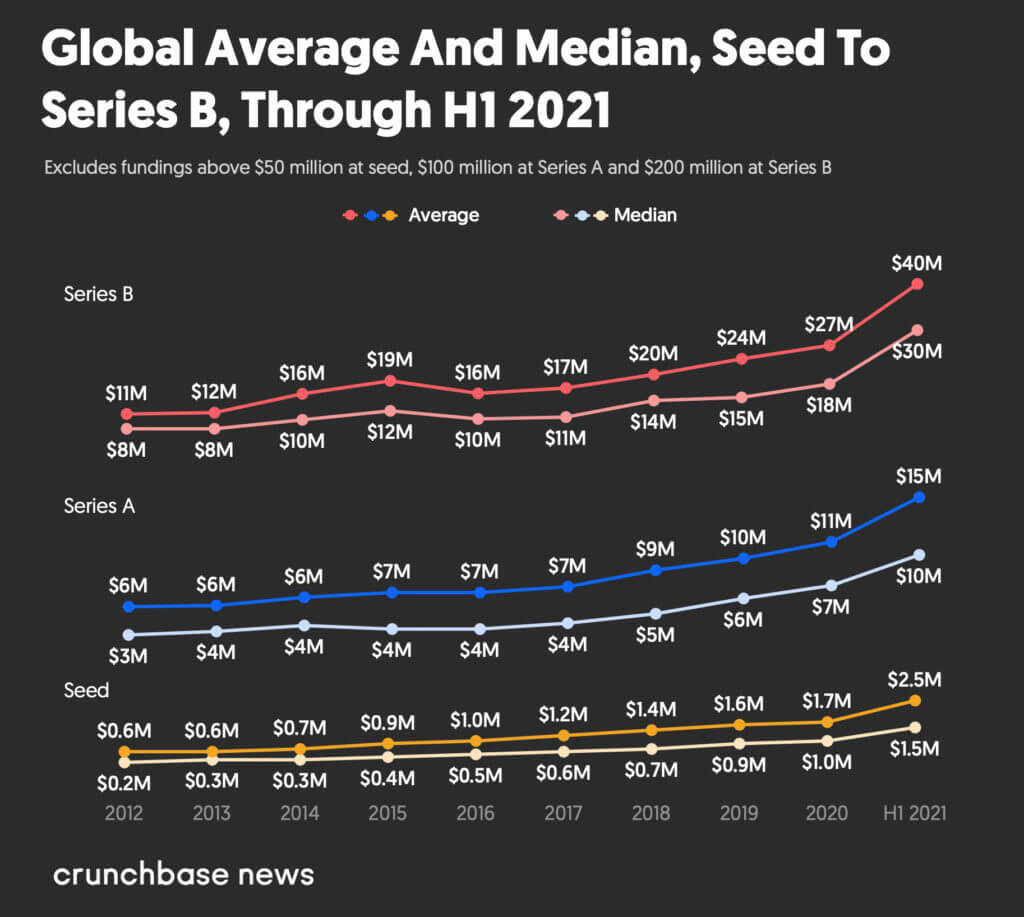

Now that you know the standard deals and multiples among companies of your size and industry, it’s time to determine how much to ask for and how to structure the deal.

So how much do you need?

The answer is simple: as much as possible. If you can raise a significant amount in your seed round, you’ll never need to ask investors for another dollar.

Ideally, you should try to obtain enough capital to take your business to a stage of profitability. However, this may not be possible at the start, and you’ll likely need to pursue additional funding rounds in the future.

When raising seed funding, aim for enough money to last until you reach your next funding milestone — generally after 12–18 months.

This Angel Investor Shares 11 Tips for Entrepreneurs to Raise Smart Money

5. Establish a list of target investors

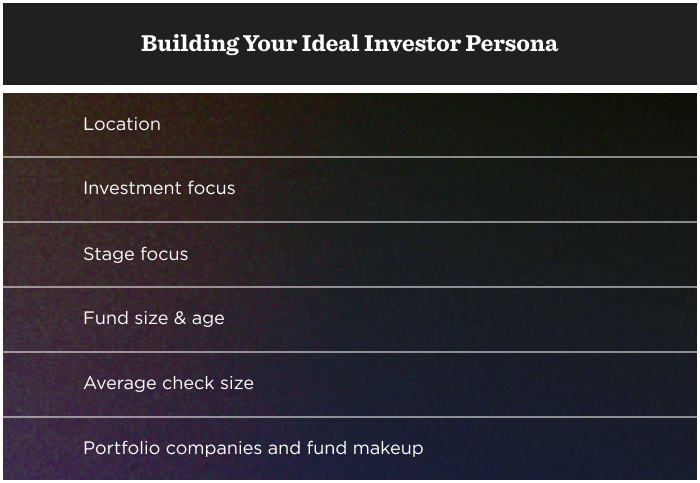

Similar to creating a buyer persona for your customers, consider creating an investor persona. Raising capital can be a full-time job, so focusing your efforts in the right direction is essential.

Mark Suster, a managing partner at Upfront Ventures, describes raising capital as a sales process where “the investor is a customer, and they have money to spend but only for a limited number of companies. They are buying trust in you that you will build a large business that will be valuable.”

So, treat your fundraising process like a sales process and build a list of prospects. You can even leverage LinkedIn best practices to search there, but you will first need to figure out what kind of investor you’re looking for.

What stage are you at in your company’s development? Do you need seed money or growth capital? Are you looking for angel investors or VCs? It’s essential to identify your ideal investor profile.

Other important factors include location, industry, fund size and portfolio composition. For example, if you are a startup focused on sustainable food sources, you should highly consider investors with a portfolio of food companies over SaaS companies.

6. Prepare a pitch deck

Your list of target investors is updated and ready to go. Now what?

It’s time to create your investor pitch deck presentation to share with investors why you are a business worthy of investing in.

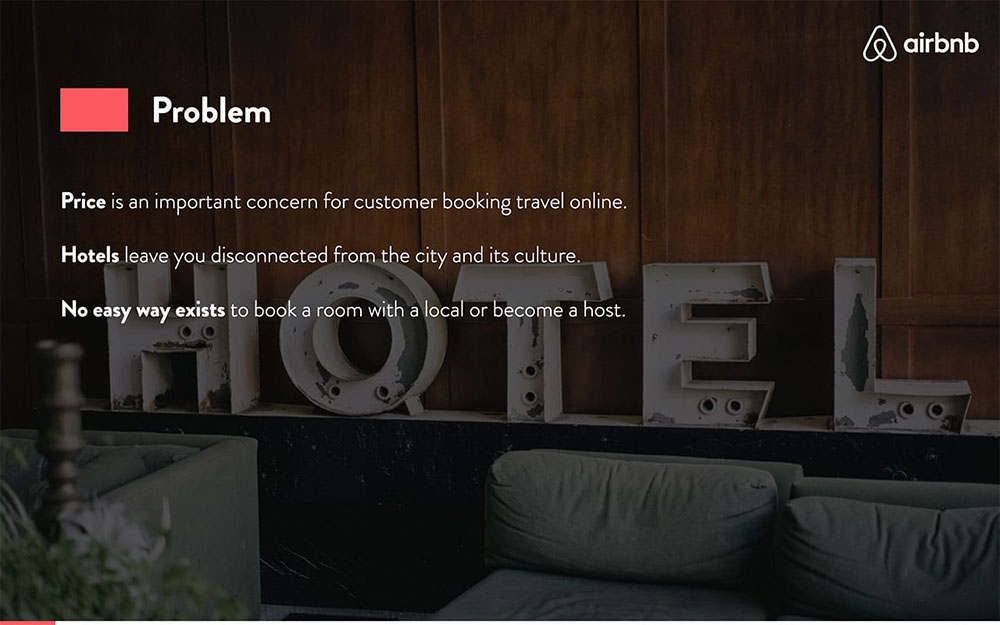

A pitch deck is a presentation you’ll use to sell your business to investors. It should include all the information they need about your company, including the problem you’re solving, how you plan to do it, how much money it’ll take and how you differentiate yourself from the competition.

It’s a sales deck, like the ones you’d see in marketing or advertising, but it has a specific format and purpose.

According to Forbes, your pitch deck should include the following slides:

- Company overview

- Mission/vision of the company

- Team

- Problem

- Solution

- Market opportunity

- Product

- Customers

- Technology

- Competition

- Traction

- Business model

- Marketing plan

- Financials

- The Ask

Most of the slides are self-explanatory, except for slide 11, “traction.”

A “traction” slide is helpful to show off any positive traction that your company has made, which will look good in the eyes of an investor. This slide can include press mentions, awards or accolades, customer testimonials, product reviews and strategic partnerships.

For example, many startups create alliances among other companies within their niche to increase their customer acquisition levels. If your startup is product-focused on young adults or teenagers, and you collaborate with a bank that offers accounts for teens, this is an excellent strategic partnership that you should include on the “traction” side of your pitch deck.

In short, this pitch deck should be a condensed version of why your business rocks and how investors can use it as a vehicle to score sizable returns.

The Ideal Pitch Deck Is A Story, A Science And An Art

Wrapping up

So, there you have it.

Whether you’re planning to reach out to investors to secure your first round of funding or are interested in finding a buyer for your business, the process is the same.

When you reach out to investors, make sure you’ve done your research and that you know your pitch front to back.

We hope these tips help guide those who are just starting up their own business or even those who have been running one for a while but are still unsure how to dip their toe into the pool of raising capital.

With these six key points, you should be ready to take it on. Although these pointers will give you a head start, there’s no guarantee that investors will jump at your pitch. So persistence is key. If you don’t get the answer you want, don’t despair — keep at it, and you’ll find your footing.