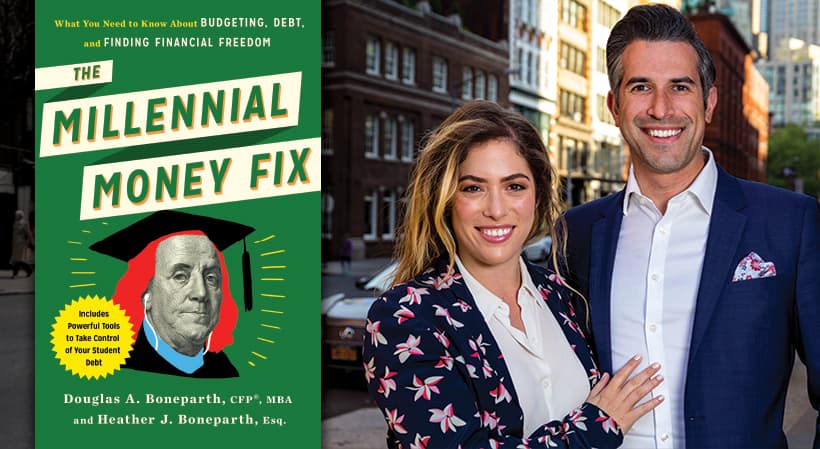

The following excerpt is reprinted with permission of the publisher, from “THE MILLENNIAL MONEY FIX” © 2017 Douglas A. Boneparth and Heather J. Boneparth. Published Career Press, Wayne, NJ. 800-227-3371. All rights reserved.

“So, uh, Douglas, how’s that nine to five treating you?”

“Nine to five,” you say? That concept is funny for the young people I know in today’s workforce. Those of us pursuing corporate jobs work longer hours than that, and the true entrepreneurs in our group never really have an off switch. For better or worse, technology has made it so we never need to (or hardly ever can) disconnect. We are master multitaskers, always available for our friends, family, and jobs, often all at the same time.

Distractions are only such if they affect our productivity toward something else. And if we can do both at once, is it so bad?

Like generations before us, millennials have an entrepreneurial spirit. What separates us is our ability to harness technology to be more productive; to achieve more in the same time given.

Some millennials discovered their entrepreneurial identity when their advanced degrees didn’t align with the demands of the job market. Unemployed or underemployed, they didn’t have a choice but to set out on their own. Others found traditional corporate roles to be bureaucratic, archaic, and infuriating. Even more felt like they were doing just fine, but weren’t happy.

If millennials in the workforce are guilty of one thing, it’s dreaming. It’s believing that we can create or offer something that could impact someone else. We don’t feel entitled to do something important. We just understand how much smaller technology has made our world. Making an impact is more possible than ever.

All this doesn’t mean you should be your own boss. Not yet, at least.

There are serious tradeoffs in becoming an entrepreneur. Although you hope to achieve limitless success, you are making a huge gamble. Foregoing your salary welcomes the peril of instability at any time—at terrible times. So much so that it’s deemed too impractical for most to consider ever doing. And not everyone is ready to go unmanaged. To flourish on your own, having patience and discipline is almost mandatory. You have no benchmarks for performance other than those you set for yourself.

Then how can a millennial with an idea or passion make an impact if he or she has too much at stake, too much student loan debt to repay, or too many mouths to feed?

By doing it on the side and hustling inches closer every day.

Related: Why Millennials Are Taking on Entrepreneurship

Hustle and grow

I don’t have a better example to share other than my own. I am a financial advisor who worked for other people before launching my own wealth management firm. At first glance, this may not seem like your classic tale of entrepreneurship: the American Dream you see on “Shark Tank.” But the careful steps I took to establish my own brand, while earning a stable income elsewhere, are translatable to anyone’s career path. Here’s how it happened.

Before I even graduated college, expectations were set for me. My father opened a satellite office of his financial planning practice in Gainesville, where I worked during school and would continue providing service afterward. He wanted this to be his succession plan and the ticket to his retirement someday. I learned much of what I know from him, no doubt. But within that first year out of college, I knew our father-son team wasn’t working out. As generous as his time and energy were, we disagreed about almost everything.

The day-to-day was growing too hard for our relationship to bear, and that wasn’t even what kept me up at night. I was captivated by helping people with their finances, but I wanted more. I wasn’t going to be happy with a lifetime of servicing my father’s preexisting relationships. I wanted to help my own type of clients, on my own terms, and in my own firm. Oh, and I wanted to move to New York City to do it.

After some interviews, I secured a position as an associate advisor in a Park Avenue practice. I wrote financial plans and performed administrative work to help my boss’s business run smoothly. In addition to my base salary, I negotiated a subsidy for my continuing education—I wanted to become one of the youngest Certified Financial Planners in the country. This would help legitimize me in a field where most successful professionals were much older. I worked like a dog servicing clients, studying and starting to figure out how I’d find clients of my own. The goal would be to phase out my base salary for client revenue. But it became clear very fast that this wasn’t going to be achieved through cold calling. I needed to be patient, keep my head down and learn.

If you are fortunate enough to work in the industry you’d like to spin off in, that’s great. Even under the thumb of someone else, you are gaining on-the-job training that applies to your craft.

You might be in for a long game, but again, you need to be patient. This is the most practical way to fulfill your financial obligations while getting closer to your goal. You can see what works and what doesn’t—and it’s not your butt on the line. Witnessing someone else’s business decisions (even when they’re wrong) can teach you valuable lessons you will have forever.

If your dreams are a complete pivot from your current career, consider this: time is your best friend. You want to be working a job that maximizes your work-life balance. Then you can invest your free time into that entrepreneurial venture. This doesn’t necessarily mean that you up and leave your full-time job to become an Uber driver. It doesn’t have to be that dramatic of a shift. There might be ways to stick it out in your current industry, but in a more limited capacity or role. You can reclaim time in your life with simple changes. You just need to look for them.

I realized that my real goal wasn’t just to be my own boss, but to educate and empower millennials. Older financial advisors were dismissing my generation as the entitled children of their clients. They had no idea how to assist with the new challenges we faced breaking into the workforce, or how to answer our unique financial questions regarding student loan debt repayment. More importantly, there were no wealth management firms run by millennials for millennials. With retirements of their own to worry about, older advisors weren’t willing to invest in people just starting their careers with challenges they couldn’t relate to. I could relate to them because I was living them. There was a crack in my industry and I hoped to be one of the first to fix it.

There will come a time when you need to make an initial investment in your business venture. It could be additional training, a piece of equipment, or straight up cash. From a numbers standpoint, give this investment as much attention as any other decision we analyze in this book. But be a little cavalier about the unknown.

Every entrepreneur should possess a bit of bravery. It’s why we are drawn to set out this way in the first place.

In pursuing my MBA, I formed relationships and even learned a thing or two about business. My expanding network of young professionals translated to new clients and referrals, many of whom were also friends. It felt so wonderful to root for them as they did for me. My investment was starting to pay off.

Right before I walked across the graduation stage at Radio City Music Hall, I took the plunge: I eliminated my base salary and started relying on only my clients to generate income. Heather and I got married in the fall before then, and her job provided us with the financial security and medical benefits we would need to leave my salaried days behind. Her stability made it possible for me to get closer to my goal. The ebb and flow of our relationship allowed this to be my time.

Sign Up: Receive the StartupNation newsletter!

From then, I went all in, setting out to prove that financial advice for millennials wasn’t a “niche”—it was the future. I sought the attention of national news organizations to become an authority on the subject and build a constant stream of press. Social media and technology helped me distribute educational content to the right people. I established relationships with nonprofit organizations and took leadership positions to affect the industry. Most importantly, I committed myself to providing outstanding service to my clients of all ages.

By December 2016, I was ready to go all in for real. I left my former organization to build my own firm, Bone Fide Wealth.

It took eight years from the day I hugged my dad goodbye in South Florida to make it happen. Eight years of training, education, patience, hustle, negotiation, compromise, success, and failure. And this is only the beginning. I’ll say it again: nothing worth doing is easy. I keep this in mind with every challenge I face.

Millennials are doers, and we are doing more than ever. Our hunger to have an impact, create, innovate and disrupt the status quo makes us natural entrepreneurs.

Pair this spirit with a solid foundation in personal finance, and you can achieve this Great Thing in Life. You can be unstoppable.

“The Millennial Money Fix” is available now at fine booksellers and can be purchased via StartupNation.com.

Reviews of “The Millennial Money Fix”