Cash is still a popular medium of exchange, but it no longer enjoys the dominance it once did. In its place are more convenient payment options such as credit cards and debit cards. In fact, roughly 80 percent of U.S. consumers prefer using plastic instead of cash.

So if you don’t already accept credit cards, you’re likely leaving money on the table.

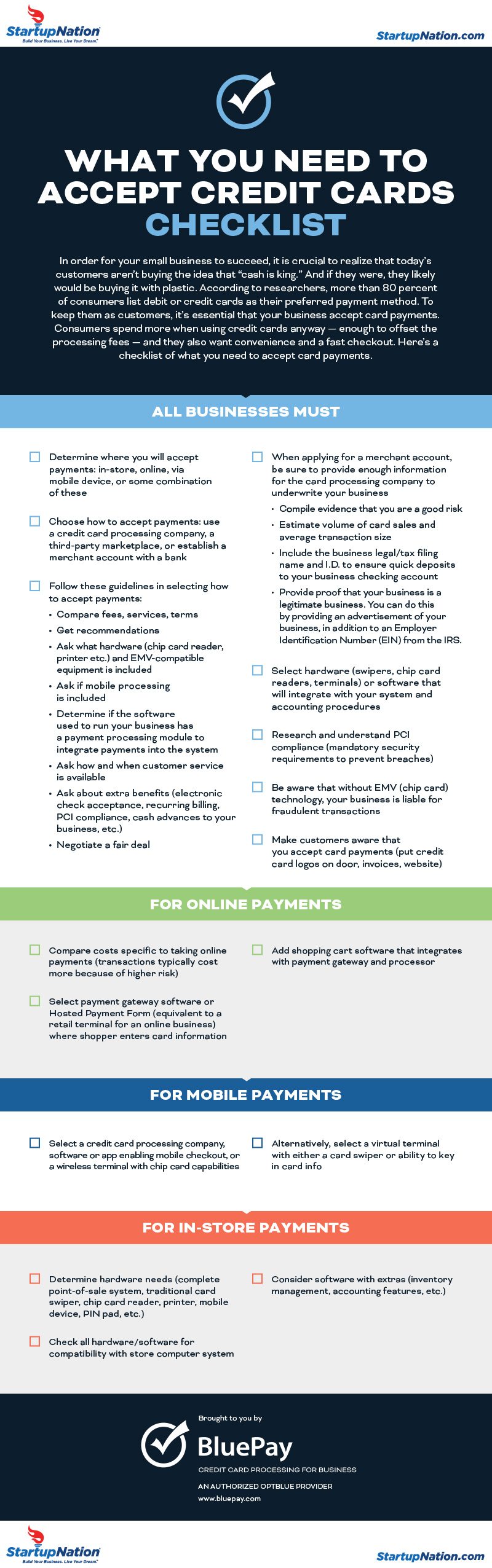

Getting started isn’t automatic, however. Below are some of the considerations to factor in as you begin exploring credit card processing solutions at your small business.

1. Payment security

Although credit cards are both fast and convenient, they are also susceptible to abuse. Every year, criminals rack up an estimated $16 billion in fraudulent charges. By 2020, that figure could reach $35 billion.

Therefore, you want a payment processor that specializes in PCI-compliant data security. Ideally, it should offer other fraud prevention tools to help safeguard your customers’ sensitive credit card data.

2. Processing fees

All credit card transactions carry fees. They’re simply the cost of doing business. However, not every fee is mandatory. For example:

- As an online merchant, you don’t need to lease a POS terminal

- As a brick-and-mortar retailer, you don’t really need a payment gateway

Related: Why Your Business Should Accept EMV Chip Cards

3. Perks and benefits

Some fees are avoidable, but others may be worth paying extra. For example:

- Payment integration can minimize time spent balancing books or updating CRM records

- Advanced fraud protection tools can help reduce your exposure to identity theft and cybercrime

Which credit card processor is right for you?

Every merchant’s payment needs are unique, so it’s worth shopping around for credit card processing solutions that satisfy your business requirements. With so many options out there, making apple-to-apple comparisons can be pretty difficult.

- How do you know you’re getting the best deal possible?

- How can you tell whether a processor is right for you?

- What add-ons are worth including or removing?

To answer these questions (and many more), be sure to read the infographic by BluePay below. This free resource walks you through the most important considerations as you begin exploring your credit card payment processing options.