Over the course of several startups and acquisitions, Michael Cloran has observed how hidden errors can lead to what he calls “technical debt” and ultimately tank an otherwise promising business.

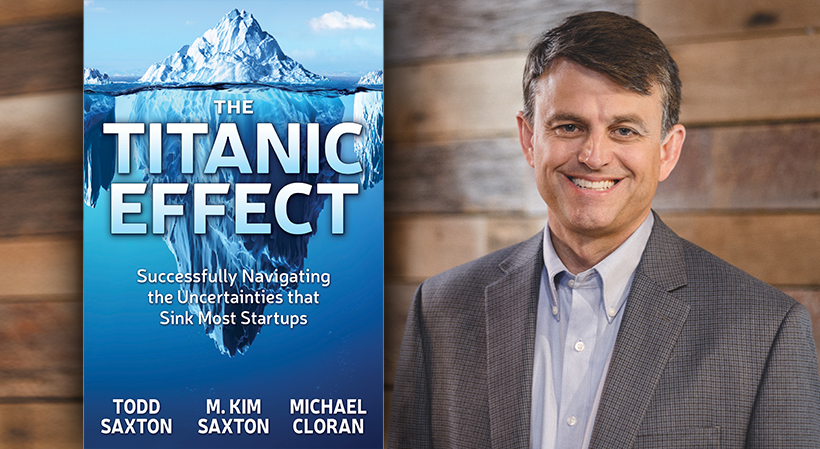

After Cloran connected with business professors and angel investors Todd Saxton and M. Kim Saxton, the trio expanded the concept to include other types of startup mistakes and coauthored a new book called “The Titanic Effect: Successfully Navigating the Uncertainties That Sink Most Startups,” released earlier this month.

StartupNation caught up with Cloran, now founder and managing partner of design and development firm, DeveloperTown, to find out how founders can prevent these hidden icebergs and keep their business afloat.

The following conversation has been edited for clarity and brevity.

StartupNation: What was the impetus behind the book?

Michael Cloran: I’ve been running a company called DeveloperTown for a long time. We work with a fair number of startups and now with large corporations. When you start a project, it’s easy to build the first three or six months of code. You want to be agile so you say, “hey, I need a place to eat.” You throw down some gravel and build a quick little shed. Now you need a window so you saw in a window. Then you need a place to park, so you add on a lean-to.

Then when you get 6, 9 or 12 months into your startup, you know the market needs a second story. But you basically built a shed with a lean-to on it, and you can’t put a second story on it without tearing the whole thing down and starting over.

Technical debt is what happens in a code base. You think you’ve got the world’s smartest software developer on board, but it gets a little slower at three months and at six months. By nine months, it’s going at a crawl.

In 2010 and 2011, after I had just raised $32 million for my last startup, I began to look into this problem and met some of my partners trying to solve that problem. We saw what’s happening and we started giving this presentation to entrepreneurs. Todd and Kim Saxton, who are professors, asked me to give a presentation to one of their groups. While I was giving the presentation they said, “you know, we see that in the startups that we work with in tons of other areas.” Kim saw startups suffering from marketing debt, and Todd saw it on the human side, in how founders put their initial agreements together, how they make sure they have a diversity of opinions and the advisors they choose.

We gave a joint presentation and people loved it. Todd and Kim said “we should write a book.” Todd had been reading about the Titanic and realized it was not just some metaphor, but the actual story of the Titanic had many of these interesting tidbits of technical debt.

StartupNation: What are some ways that entrepreneurs can avoid those debts?

Michael Cloran: Everybody thinks entrepreneurs are the new heroes, so no one wants to be the one that’s going rain on your parade, and it’s a self-reinforcing cycle. We train people to go out and when you have somebody that’s in your target market, let them tell you how great it is and then just ask them for a simple non-binding letter of intent. Just say, “Look, I’m going to go raise money for investors and I would love you to just put on a piece of paper that if I build this and it does A, B and C, that you’d buy it.” Make it real, make it completely non-binding and see their reaction.

What people immediately get is “Oh well, I mean it’s great for other people, but I couldn’t use it because …” It’s the old adage value of, “If you want to raise money from someone, ask them for advice and if you want advice ask them for money.” It’s the same thing in a customer validation sense. Even though it’s non-binding, most people know that your word is your bond in business, and that you have to now mean it.

Related: 3 Marketing Mistakes That Are Crushing Your Business

StartupNation: How did your entrepreneurial experiences impact the book?

Michael Cloran: I’ve had the pleasure of spending tens of millions of dollars of other people’s money on tuition, so I have learned an enormous amount. I’m pretty sure I could say I’ve made every mistake that’s in the book. But at the same time, I had some great successes and some great fun. Back in the nineties, I had a $25 million offer and held out, sold it for $4 million, so I learned a lesson there.

I built a company, completely bootstrapped, and raised extra capital for it but we had some wrong advisors in place. We sold that company for tens of millions of dollars, but the bad news was only six and half million was in cash. The rest of it was stock, and that was in 2000 to 2001, so I got to learn the eight figure lesson of the crash.

StartupNation: You’ve invested in startup companies and as a founder, you’ve raised money and also bootstrapped. What is your advice to other founders on bootstrapping versus raising outside capital?

Michael Cloran: This is one where it can be incredibly valuable to get the right advisors because the answer is, it depends. The company that I started in 1995, we didn’t take any outside money, and we sold it for a lot of money. But in hindsight, if we had raised money for it, we could have put a few zeros on the outcome?

By the same token, I bootstrapped another company for three and a half years on my own money. By the time we did raise money, we had too much money too fast. In retrospect, I should have raised money earlier and then I should have raised less money before we poured the real gasoline on.

It really is just so situationally dependent that you’ve got to have advisors that really know what they’re doing and they’ve got to be advisors that are not conflicted.

Sign Up: Receive the StartupNation newsletter!

StartupNation: Is there anything else you’d like readers to know about you, your work, or the book?

Michael Cloran: Todd and Kimberly took the ball on making it a book. We’re going to be launching this Titanic Effect Index, and there’s a really super MVP rough draft of it in the book. But the idea is to get startups out there to come in and answer a few questions about each of these areas. We’ll have people answer these questions and then let people get insight into different startups at different periods. That to me is an exciting second action of the book. If we can gather a few thousand entries in that world, I think super fascinating insights that could come out of that.

“The Titanic Effect: Successfully Navigating the Uncertainties That Sink Most Startups” is available now at fine booksellers and can be purchased via StartupNation.com.