It’s not easy to build a startup from scratch and take it into the stratosphere on your own. Bootstrapping your business can be severely financially and emotionally taxing — with no guarantee of success in the end. To counter this, many entrepreneurs seek to access funds via venture capital.

By demonstrating appeal to venture capitalists who like your business idea, it’s possible to secure significant windfalls in funding — usually at the cost of a percentage of equity. However, this approach is far from foolproof, and most businesses still fail to turn their funding into a long-term success over time.

(Image: Findstack)

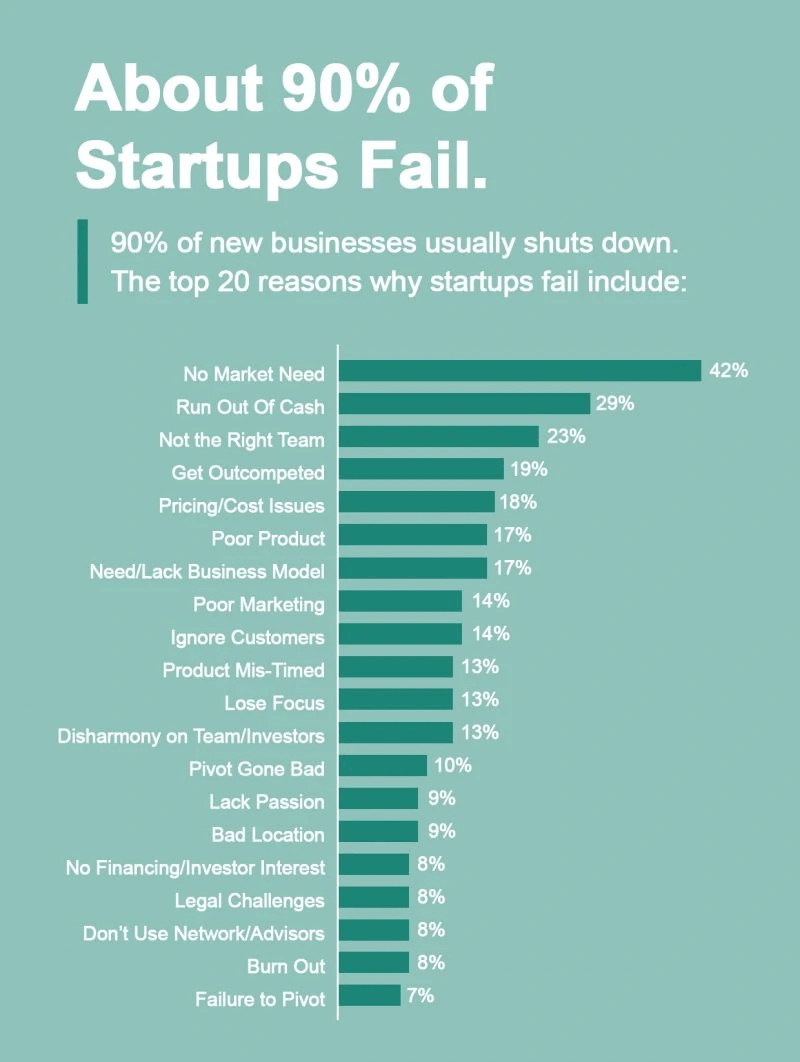

As the chart above shows, running out of money is one of the leading reasons why a business idea fails. With very few entrepreneurs in a position to source funding for their venture single-handedly, VC investments have become an essential right of passage.

But how can entrepreneurs work on their appeal during such a selective process? And what actionable steps can be taken to leverage the best possible chance of success? Let’s take a deeper look at some VC pitch essentials that all entrepreneurs can benefit from:

Have a plan

Most businesses start out as an idea, but some entrepreneurs fail to allow their idea to blossom into a functional plan. This stands as one of the most basic requirements for any startup with intentions of growing beyond a simple single-person endeavour.

When it comes to securing money, the first thing prospective investors will look for is a business plan, and founders must build their own plan that clearly outlines the path to profitability and growth for a business backed up by real data, market insight, and early KPIs.

Some entrepreneurs allow themselves to get bogged down by the creation of a business plan, but the process doesn’t have to be more complicated than it already is. There’s no need for a good business plan to be complex or even original. As long as the content is thorough and honest in spotting future risks and opportunities, it can be an important text for stakeholders and investors alike.

Be sure to also make it abundantly clear to all reading what your business goals are, and how you intend to accomplish them. Nobody wants to invest in a business without having an idea of where it’s likely to go.

Most Read: The Ins and Outs of Owning a Subway Franchise

Build a summary that resonates

Summaries are another essential part of the investment process. Rather than sending fully fledged unsolicited business plans to VCs who would never have the time to read them, it’s vital that you summarize your plan into a short and punchy pitch that can help to establish interest.

When it comes to winning the attention of an investor, most recipients will prefer emails with a summary memo attached consisting of a few paragraphs, rather than deeply detailed summaries — with them preferring to tackle the latter later on.

However, it can be beneficial for entrepreneurs to create a compelling pitch deck to send to prospective investors in addition to a summary – which can act as a strong piece of further reading for those interested in finding out more about your idea, and how it can generate money. This means that the purpose of the pitch deck can transcend presentation environments, and they may even help you to close out deals for funding when sent remotely.

The Ideal Pitch Deck Is a Story, a Science and an Art

Create a winning pitch deck

To create a great pitch deck, it’s important for entrepreneurs to establish a healthy balance between informative content and attention-grabbing slides.

VCs will have to deal with countless pitches each week from eager business owners, which means that they’re unlikely to be moved by a plain slideshow filled with bar charts and cash flow forecasts.

Your pitch deck should be capable of supporting a 10-minute talk about the finer details of your company, and for best results, entrepreneurs should seek to use leading tools like Powered Template as a means of creating an appealing experience for venture capitalists as you sell your business to them.

The platform showcases a broad range of business-themed slideshow templates. Alongside business plans, road maps and structure slides, it’s also possible to download rich charts and graph templates that enable users to display metrics in a visually appealing manner.

Although life as an entrepreneur can be difficult when you’ve yet to secure funding, platforms like Powered Template can take the strain out of your VC pitches by providing time- and money-saving pitch decks that can get your startup noticed. The road ahead may be long, but a powerful pitch deck can provide you with the best chance of long-term success in the future.