Throughout his career as a serial entrepreneur, Ryan Blair has created and sold numerous companies for hundreds of millions of dollars. Blair is the former CEO of ViSalus, a healthy lifestyle company that went from startup to more than $1.6 billion in cumulative sales. Currently, Blair runs HashTagOne, where he and his partners invest in high growth seed and series A stage companies, providing capital to startups and teams that inspire them.

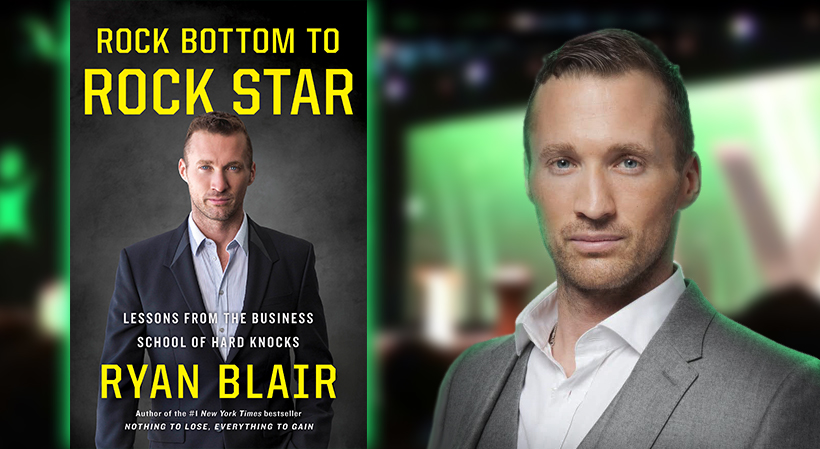

His first book, “Nothing to Lose, Everything to Gain,” was a New York Times bestseller, and his second, “Rock Bottom to Rock Star,” was published in October 2016, and excerpted on StartupNation.com here.

StartupNation sat down with Blair to learn more about how he mentors entrepreneurs through the funding process, his tips for securing funding and more. The following conversation has been edited for clarity.

StartupNation: What led you to step down as CEO of ViSalus in order to run your VC firm, HashTagOne?

Ryan Blair: Mostly I felt it was the right time to step down from ViSalus. I spent 12 years taking the business from near bankruptcy to healthy profits. I also wanted to focus more on investing in and mentoring entrepreneurs through my VC firm.

After publishing my two books about entrepreneurship, it’s a natural step to spend more time coaching entrepreneurs through funding, which is often one of the most difficult parts of starting a company.

As a former entrepreneur, what unique perspective do you bring to those looking for investment?

I’ve been in startup founders’ shoes and intimately know the highs and lows of starting and running a company. I’m often called an “anti-VC” venture capitalist because I’ve turned the concept of traditional VC firms on its head. Some VC firms demand up to 50 percent equity and prioritize their bottom line over the health of the startup. I mentor my portfolio companies and help them achieve success in a nurturing, responsible way.

Related: Rock Bottom to Rock Star [Book Excerpt]

What characteristics do you look for in a startup that makes you decide to invest?

My team and I have devised a 1,000 point scoring system we use to determine if a startup is a good fit, but I look for positive traits in the entrepreneurs, such as the desire to win, ability to handle pain and commitment to excellence. I also look for a weird trait or flaw that adds value to society. After assessing the positive traits, I make sure that the negative traits of the startup/entrepreneur are traits that I can stylistically work with. I have thousands of entrepreneurs at my door trying to get me to invest in them. When screening an entrepreneur, I try to find reasons to say no. I do so because I want to add as much value to the person or business well beyond my capital resources. I am not going to invest in someone if all I can offer is money.

If you could give one piece of advice to an entrepreneur looking for funding, what would it be?

You need to become a student of fundraising. Read every book, blog and watch every YouTube video out there on the subject.

That’s how I learned to master fundraising with no college degree. I taught myself until I mastered the art.

Secondly, you need to know all of your options. There are many ways to achieve fundraising such as loans, grants, VCs, friends and family, angels and deferred equity. You have to know how each option will lead you to achieve your fundraising goal.

What are your thoughts on alternate funding options, such as crowdfunding?

Since I have structured HashTag One as a VC firm to eliminate “traditional VCs,” I find crowdfunding to be a great tool to eliminate unnecessary jobs and structure in the venture capital industry.

Related: Sign up to receive the StartupNation newsletter!

What is the biggest takeaway from your latest book, “Rock Bottom to Rock Star”?

Failure is the key to success and growth. I’ve actually failed more times than I’ve succeeded, but the several successes I’ve had have more than covered my losses on the projects that didn’t work out the way I had planned.

Rock bottom is the best foundation you can start from, because it takes you to a place where you have nothing to lose and everything to gain.

I’ve spent nearly $2 billion dollars over my 20 year career learning what not to do, and on a few occasions, what to do and why. This is what I share in my writings and I love to see when people actually learn from my hard-fought wisdom.

Is there anything else you’d like the StartupNation audience to know about you or HashTagOne?

I just want to make as big of an impact as I possibly can by sharing my journey and helping others along the way. I want those that I’ve helped to pay it forward by improving upon my work. At the end of my days, I’d like to measure my impact in billions, not millions, of people.