Revenue is an exciting and vital performance metric to track when starting a new business, but it’s not the only one an entrepreneur should be concerned with.

While there are myriad metrics that experts across the board will argue will justify your fantastic idea to potential investors, here are six time-tested metrics you should pay constant attention to if you want to grow your startup into a successful business.

Metric 1: Customer Acquisition Cost (CAC)

In the early stages of your new business, you must acquire new customers to grow. This, of course, costs money, which turns into a discussion of how much is worth investing in acquiring said customers to stay profitable.

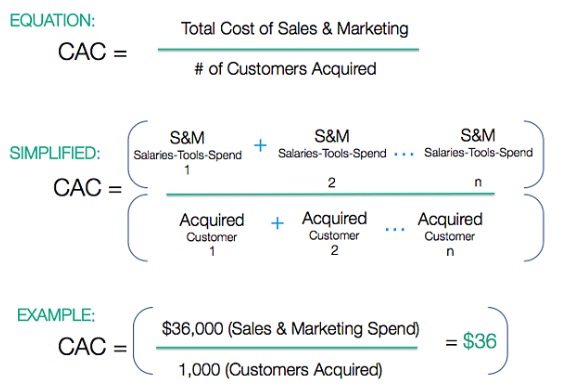

To calculate customer acquisition cost, divide marketing and sales costs (including any overhead costs in these departments) by how many customers you picked up in a given period.

Too high a CAC means you are spending too much money to acquire customers. To lower that number, you need to look at optimizing your conversion funnels and sales processes, assuming that you can’t reduce your marketing costs.

Tools like Optimizely can be incredibly useful when testing different variables in order to increase your conversion rate and lower your CAC.

Related: A Beginner’s Guide to SEO: Common SEO Metrics

Metric 2: Retention

Many business owners become so enamored with the idea of business acquisition that they forget what keeps their livelihoods going, which is retention.

When you focus too much on acquiring new customers, you neglect your current customers, who are loyally pouring their hard-earned dollars into your business. And when you ignore them for too long, they will go elsewhere.

To get to the heart of retention, you should ask yourself what you look for when engaging companies you spend your own money with.

How often do they interact with you? Are they continually providing you value? Do they understand why you do business with them instead of their competitors?

Up-selling and cross-selling to current customers have a 60 percent to 70 percent success rate, while selling to new customers sees only a 5 percent to 20 percent success rate.

Couple that with a 5X increase in cost to acquire new customers compared to retaining existing ones. Retention is a huge opportunity for every business to increase profits.

If you’re struggling to understand the kind of customer you should spend your energy on, here on two examples of customers desperately seeking your attention:

- Current: Current customers would love to tell you how you can improve your business, and how they could be more satisfied. These customers enjoy giving their opinions and won’t be bothered if you provide them with the platform to speak.

- Inactive: If a customer has stopped using your product or has slowed their use, they should be asked why. Again, they can be a source of great information, and it is in your best interest to use this opportunity to learn about how to best serve these customers.

Metric 3: Churn

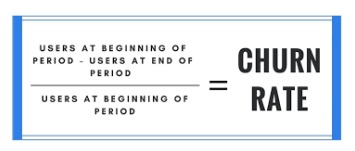

Churn, or attrition, is a measure of how many customers stop paying you for your product or service.

While some startup businesses start measuring churn at 30 days, many others wait until 90 to give inactive customers the chance to come back before measuring customers who have no intention of doing business with you again.

It’s a given; you will lose customers. What you can do to lessen the frequency is find out what a profitable loss is to you. When customers leave your product or service behind, it’s a good idea to survey customers on why they left.

Tools like SurveyMonkey make this process incredibly easy.

This way, you may find out why certain customers have decided to stop paying for your product or service, and what you can do in the future to prevent this from happening again with the next customer. And you might even learn how to win those customers back.

Metric 4: Lifetime Value (LTV)

Lifetime value is how much you expect to earn from a customer in the time that they do business with you. That means that initially, you must know how long you expect each customer to stay with you.

For example, if you have a monthly subscription business model, do your customers stay for six months, 12 months or longer?

To calculate the LTV, you multiply the monthly revenue from that customer by the number of months they stay with you on average. For a true LTV, you must include all expenses related to the maintenance of your product.

For a viable business model, you need your LTV to be higher than your CAC. Basically, you need to pay less to acquire customers than you make on their lifetime.

A good rule of thumb for recurring revenue models is to have your LTV to be 3 x CAC.

Metric 5: Viral coefficient

Normally when a startup launches a new product, they will invite people within their existing network to try it out. This could be anything from a new clothing line to a business SaaS product.

If the product is well received by these beta customers, then they will tell their friends and so on. This is the viral coefficient or organic growth rate of your company.

When calculating the viral coefficient, the inputs include:

- Initial number of customers

- Number of invites sent to each customer

- Percentage of invites sent that converted

You would continue this process over several cycles to determine your viral coefficient.

A positive viral coefficient rate means you’ve found a good product/market fit, and customers are having a positive user experience, with low cost of acquisition and high profitability.

Sign Up: Receive the StartupNation newsletter!

Metric 6: Revenue

This could possibly be the most important metric to pay close attention to because it’s focused on profitability.

Are you actually making money?

Revenue is the income that your business generates, which is usually reported as “sales” from customers purchasing your product or service. It can also be generated from other things like late fees or interest.

Depending on your business model, you may need to be prepared to pay out a lot of expenses before receiving revenue that clears a profit.

For example, if you’re a SaaS company, customers usually pay in small monthly increments which generate a profit over time, but you need to be able to float your expenses in the meantime.

One way to avoid this is to require customers to sign longer contracts or pay in advance for an annual subscription.

Bringing it all together

All of the above performance metrics work together. However, we know that with limited time and resources, it can be difficult to measure all of them at once as you’re just starting up your business.

The more you know about your own business, the better informed you are when it comes to making critical decisions. Start small and focus only on the KPIs that affect your bottom line, such as revenue, customer cost acquisition, lifetime value and churn. Then, study your retention and your viral coefficient to help you understand what your long-term viability looks like.