The rise of the gig economy has reshaped the way Americans approach their careers. Just a decade or two ago, “moonlighting” was frowned upon by many employers, but attitudes have changed.

Today, it’s not uncommon for full-time employees to have a side gig as they pursue their entrepreneurial passion or dream. Many entrepreneurs use the gig economy as an entry into what they hope will become a full-time career.

A 2016 McKinsey study found that up to 162 million people in Europe and the United States engage in some type of independent work. Most experts believe the gig economy is here to stay, with projections for it to increase to 43 percent of the workforce by 2020.

To learn more about how Americans approach their side gigs and small businesses, CompareCards.com by LendingTree conducted a national survey of 1,000 American adults who report having a side gig or small business. The survey was conducted September 18 through 23, 2017. We also talked to entrepreneurs to find out how they manage finances, and profile a success story below.

Key findings

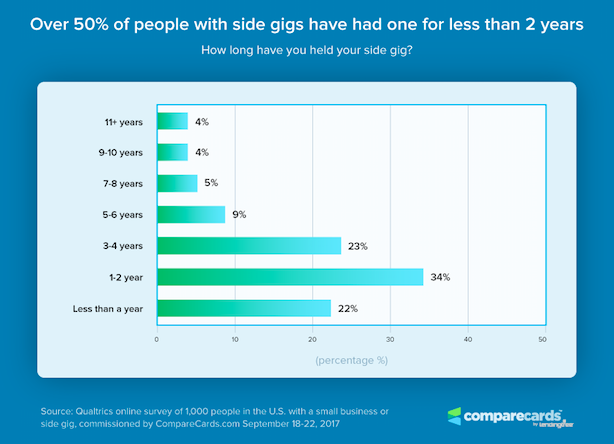

Many in the gig economy are relative newcomers. Over 50 percent of people with side gigs have had one for less than two years, the survey found.

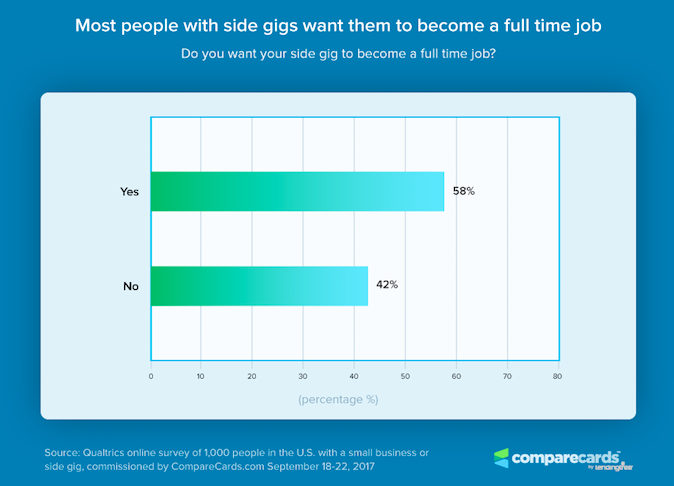

Many people want to ditch their 9 to 5 job. Most survey respondents (58 percent) with side gigs want to turn them into a full-time career, the survey found.

- Millennials (62 percent) hope to make their side hustle a full-time job, more than Baby Boomers (at 44 percent)

- Seventy one percent of people with an arts and crafts side gig, like Etsy, hope to make it full-time

Why do some people want to turn their side gig into a full-time job?

“They’re unhappy in corporate America and don’t feel like they’re making a real difference. They’re seeking happiness and fulfillment. If they can make money doing what they love, they’ve achieved their ultimate career goals,” Maddy Osman, founder at The Blogsmith, said.

She speaks from the experience of turning her side gig into her full-time job.

Related: LinkedIn ProFinder Shares Advice for Navigating the Gig Economy

Business expenses

The CompareCards.com survey focused on how people handle business expenses, from gasoline to internet to office supplies:

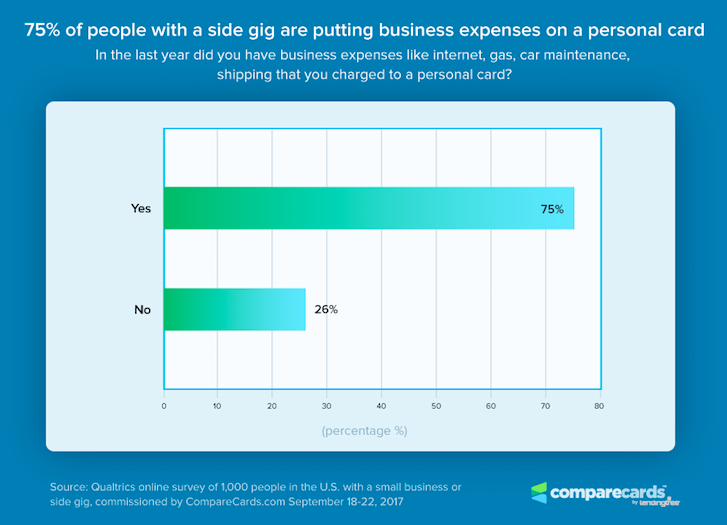

- Seventy five percent of aspiring entrepreneurs with a side hustle charged business expenses like internet, gasoline, car maintenance or shipments to a personal credit card in the last year

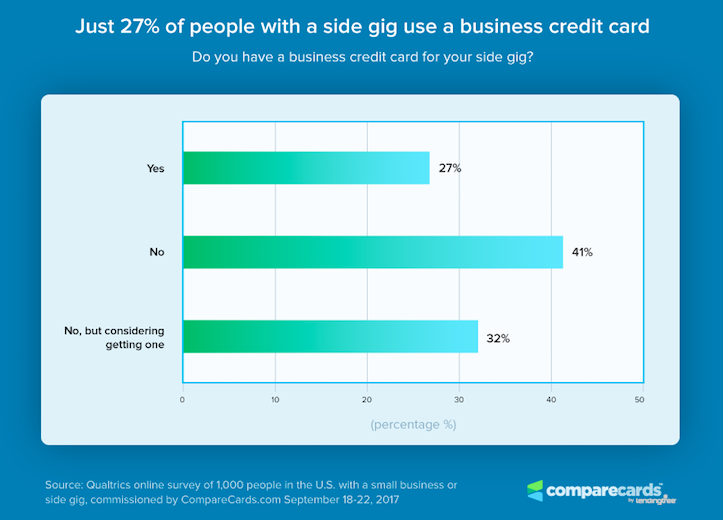

- Only 27 percent of gig economy workers have a business credit card, but 32 percent said they were considering getting one

Most people with a side hustle mix personal and business finances, the survey found. That could be a mistake, especially when it comes to reconciling with Uncle Sam.

A key advantage of using a separate credit card for business expenses prevents the commingling of personal and business expenses, Michael Slack, lead tax research analyst at The Tax Institute at H&R Block, said.

“Though use of a separate account for business purposes is not required, one question the IRS often asks when examining small businesses is if separate accounts were utilized for business and personal expenses. Using one account for both only leads to the potential for more scrutiny on the items claimed as deductions,” Slack said.

Startup success story: the quest for financing

Many entrepreneurs face challenges accessing startup capital. Small business loans can be tough for entrepreneurs with no business credit history to acquire. Some entrepreneurs, out of necessity, turn to business credit cards to fill that gap.

“When we launched our business two years ago, we had no money and no outside capital to get started,” Bryan Clayton, CEO of GreenPal, a self-described “Uber for lawn care” company, said.

Like most tech startups, they went on the fundraising circuit talking to angel investors and venture capitalists begging for money, Clayton said. After being told no over 40 times, he turned to a business credit card to fund his startup costs.

“I was fortunate enough to get a business credit card, and this enabled my team to tap an unsecured line of credit for $85,000 to get our business started. We went this route versus a personal credit card because we could only secure $25,000 on a personal card and we needed $80 to $90,000 to fund our first six months and get our beta version of our app built,” Clayton said.

GreenPal paid off the credit card debt in the first year. This year, the firm is projected to surpass $3 million in annual revenue, Clayton said. Looking back, he’s glad the investors said no.

“With their capital, they would have owned and controlled 30 percent of our business. Because we are self-funded, my co-founders and I own it all,” Clayton said.

Entrepreneurs miss out

There is a knowledge gap about the tax deductions and benefits surrounding business credit cards, the CompareCards survey found.

- Fifty five percent of gig economy workers don’t know that tax deductions are available for business credit card fees (e.g., annual fee, late fee, etc.)

- Forty four percent of small business owners didn’t know that “the fees business’ pay to accept payment from a customer’s credit card are tax deductible”

Recipe for success

For Clayton, entrepreneurship has meant the “opportunity to live out my ‘why.’” He has been in the landscaping industry for 15 years after he started cutting grass in high school. Clayton grew his first company to over 100 people.

“Creating something bigger than myself was a fulfilling experience. Our company created prosperity for our people and that’s why we did what we did. This became our company’s purpose, our ‘why.’ Now with GreenPal, I get to live out my ‘why’ by helping small lawn care services grow their business by giving them the opportunity and a platform to grow their business with less headaches,” Clayton said.

Sign Up: Receive the StartupNation newsletter!

Advice for entrepreneurs

Know your value proposition.

“One big mistake entrepreneurs make when starting a new business is their failure to understand their value proposition,” Clayton said. “What is it about their product, service and offer that compels people to say yes? Until they know this, any marketing efforts or spend in any channels will be like pouring gasoline on wet leaves… Nailing your value prop first is crucial.”

Osman added: “Hustle, but not forever. At the beginning, you’ll be working twice as hard to get things going, but eventually, your work should taper off. Working 12 hour days and weekends is not a life, no matter how much you love what you’re doing.”